With direct deposit being the most popular payment method for employees, you may decide to jump on the bandwagon at some point. But if you’ve never paid employees via direct deposit before, you probably have a few questions about the direct deposit setup process. To ensure your direct deposit is ready to roll, learn how to set up direct deposit for employees.

Before setting up direct deposit…

Setting up direct deposit for employees is exciting. However, it comes with a few additional responsibilities. Before you make the big jump to paying employees with direct deposit, it’s best to know:

- What direct deposit is

- Laws pertaining to it

- What you’re looking for in a direct deposit provider

As a brief refresher, direct deposit is an electronic funds transfer (EFT) that deposits an employee’s paycheck directly into their bank account. This means you can deposit an employee’s wages into their account regardless of where you’re located and can save money on check supplies.

Rules for employer direct deposit can vary from state to state, so it’s best to brush up on laws before you set up direct deposit. For example, some states allow employers to make direct deposit mandatory while others do not. Do your homework to find out direct deposit laws you need to follow in your state.

Prior to starting your search, get a good idea of what you need and want from a direct deposit service or provider. Research time options, average costs, fees, and requirements.

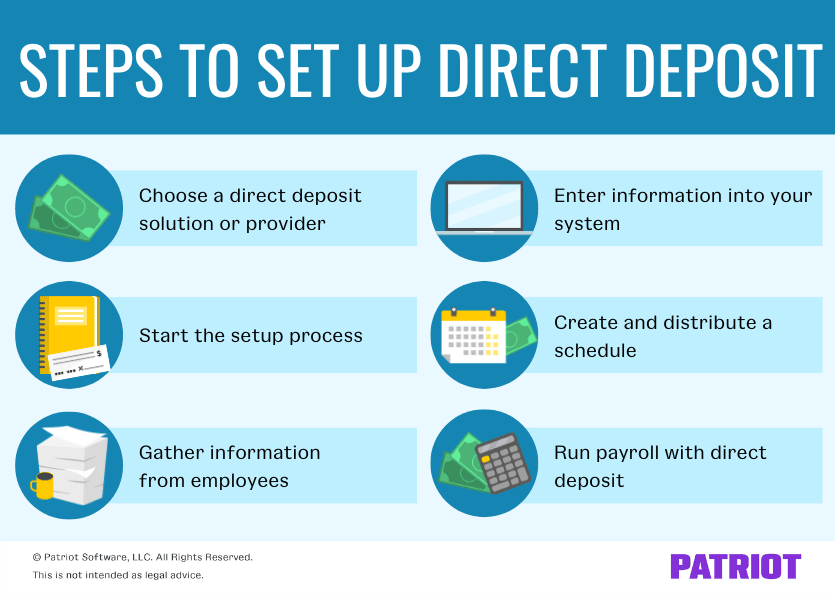

Steps on how to set up direct deposit payroll for employees

Ready to learn how to set up direct deposit payroll for small business? Of course you are! Lucky for you, you can generally get your direct deposit up and running with just six simple steps. Ready, set, go!

1. Choose a direct deposit solution or provider

In order to pay employees with direct deposit, you need a way to transfer the funds. Typically, employers use the following for direct deposit:

- Payroll software

- Direct deposit software

- Banking institution

Again, when looking for a direct deposit solution, you need to consider factors like:

- Lead time (e.g., 2-day direct deposit)

- With payroll software, you typically need to run payroll a few days in advance in order for your employees to be paid by a certain date

- Costs

- Transaction fees

- Setup fees

- Expedited direct deposit fees

- Requirements for set up

- Bank account information

- Employer identification number (EIN)

- Employer information

- Statements and documents

Before making any decisions about a direct deposit solution, do your research to find out which options you have. If you currently use payroll software, ask about their direct deposit capabilities, cost, and timing. If you’re looking into using your bank or a type of software, consult the company to ask questions to help narrow down your list.

2. Start the direct deposit setup process

Once you choose a direct deposit provider, it’s time to start the setup process. The information you need to provide can vary depending on the provider, but generally you need the following:

- Application (online or in-person)

- Business owner’s information

- Name

- Address

- Social Security number

- Identification card (e.g., driver’s license)

- Owner’s date of birth

- Company information

- Business address

- Contact information

- EIN

- Banking information

- Name

- Account type

- Account number

- Bank contact information

- Statement(s)

- Other documents (e.g., proof of EIN)

Again, check with the provider you select to find out what information you need to gather for them to set up direct deposit.

Depending on the software or provider you go with, it may take days or a couple of weeks to get everything ready to rock and roll. So, give yourself ample setup time (aka, don’t wait until the day before payday to set up direct deposit).

3. Gather information from employees for direct deposit

Get your direct deposit all set up? Great! Now it’s time to collect all of your employees’ information for direct deposit payments.

Collect the following from each employee:

- Bank name

- Bank account and routing numbers

- Account type (checking or savings)

- Amount (e.g., 80% in checking, 20% in savings)

To make this step a breeze, consider asking employees to fill out a direct deposit form. If you use forms, keep them in your payroll records for safekeeping.

If your employees have an employee self-service (ESS) portal, check to see if they can enter their information directly in their portal account.

4. Enter information into your system

After gathering employee direct deposit information, enter their information into your system. Depending on the system you use, you may need to enter each employee’s information manually. In some cases, you may be able to upload information using a spreadsheet. Check with your provider to see what options are available.

If you use payroll software that connects to an ESS portal, you likely don’t have to worry about this step. The information should automatically transfer over employee information into your payroll account. And voila! You’re ready to run your first payroll with direct deposit.

5. Create and distribute a schedule

To keep employees in the loop about when they should expect money to be deposited into their accounts, create and distribute a direct deposit schedule.

Outline which dates employees will get paid on your schedule. If a payday falls on a bank holiday and you need to pay employees sooner, indicate it on your schedule. You can distribute schedules to employees via email or through an employee portal. Or, you can hand out paper schedules in person or post the schedule in a secure spot at your business (e.g., in the break room).

If you have payroll software, check to see if your provider automatically sends out a direct deposit schedule to employees.

6. Run payroll with direct deposit

Now onto the fun part: Finally running payroll with direct deposit!

Depending on the timing, be sure to run payroll as many days in advance as you need to ensure your employees are paid on time. For example, if your payroll software offers three-day direct deposit, you need to run payroll on Tuesday for a Friday pay date. And again, you may need to run it even more in advance if the payday falls on a bank holiday.

Also, let your employees know when you need them to submit their timesheets to ensure you pay them on time.

After running payroll for the first time with direct deposit, make sure everything went off without a hitch. Check with employees to ensure they receive their first direct deposit on time. If you run into any complications, resolve them before your next payroll run.

This article has been updated from its original publication date of May 9, 2018.

This is not intended as legal advice; for more information, please click here.