You’ve finished distributing Forms W-2. Just when you think you’re done, an employee comes up to you, hands you their form, and asks, Why are my W-2 Box 1 earnings less than my Box 3 and Box 5 earnings?

Panicked, you glance over the W-2. That doesn’t help.

You do a quick search of Form W-2 on the web, but you’re too overwhelmed to get a quick, specific answer to your employee’s question.

Were you wrong? Do you need to issue a corrected W-2? Most likely, no. But, you need to understand why Form W-2 Box 1 values are higher or lower than other values on the form.

About Form W-2 Box 1

You likely know that you must report an employee’s wages and withheld taxes from the previous year on Form W-2. But, Form W-2 details stump many employers and employees.

Box 1

If you imported information from your payroll software or used a tax preparer, you may not know the ins and outs of Box 1.

However, understanding W-2 form basics is key to fielding employee questions. So, what is Box 1?

Box 1—wages, tips, other compensation—contains an employee’s total wages subject to federal income tax. Do not include pre-tax benefits in Box 1.

Per the IRS, list the following taxable wages, tips, and other compensation in Box 1:

- Total wages, bonuses, prizes, and awards you paid an employee

- Noncash payments

- Tips the employee reported

- Certain employee business expense reimbursements

- Accident and health insurance premiums for 2%-or-more shareholder-employees (if you have an S Corp)

- Taxable cash benefits from a Section 125 cafeteria plan

- Employee and employer contributions to an Archer MSA

- Employer contributions for qualified long-term care services, if coverage is provided by an FSA

- Taxable cost of group-term life insurance in excess of $50,000

- Non-excludable educational assistance payments

- Amount you paid for an employee’s share of Social Security and Medicare taxes, if applicable

- Designated Roth contributions

- Distributions to an employee’s nonqualified deferred compensation plan or nongovernmental Section 457(b) plan

- Qualifying Section 457(f) amounts

- Payments to statutory employees who are subject to Social Security and Medicare taxes but not federal income tax withholding

- Insurance protection under a compensatory split-dollar life insurance arrangement

- Employee and employer contributions to an HSA, if includible

- NQDC plan amounts includible in income due to Section 409A

- Nonqualified moving expenses and reimbursements

- Payments made to former employees who are on military duty

- All other compensation (e.g., scholarships and fellowship grants)

Related boxes

Box 2 shows how much federal income tax you withheld from Box 1 wages throughout the year. The numbers in Box 1 and Box 2 help determine an employee’s tax refund or liability.

Most benefits that are exempt from federal income tax are not exempt from Social Security tax. Box 3 reports how much money an employee earned that was subject to Social Security taxes during the year.

Because some benefits are not subject to federal income tax, Boxes 1 and 3 (as well as Box 5) can have different values. Likewise, you may see W-2 Box 1 and Box 16 differ. And, the values in Box 1 and Box 18 may also vary.

Reasons for W-2 form Box 1 wage differences

Here are a few common reasons for differences between Box 1 wages vs. Social Security wages, Medicare wages, and state and local income wages:

1. The employee elected to contribute to a retirement plan

If an employee elected to contribute to a pre-tax retirement plan, their W-2 Box 1 wages are likely lower than their Box 3 wages.

An employee’s elected retirement plan contributions are not subject to federal income taxes. However, these contributions are subject to Social Security and Medicare taxes.

Report the amount of an employee’s retirement plan contributions on Form W-2. Use code “D” in Box 12 and check the box below “Retirement plan” in Box 13.

Do you contribute to an employee’s retirement plan? If so, do not include your contributions on the employee’s Form W-2.

An employee’s elected contributions to a Roth retirement account are subject to federal income tax, Social Security, and Medicare taxes.

Let’s say an employee earning $50,000 contributed $2,000 to their 401(k) during the year. The employee’s taxable wages in Box 1 are $48,000. The employee’s taxable wages in Boxes 3 and 5 are $50,000.

Retirement plan contributions might be subject to state income tax, depending on the state. Some states follow federal rules when it comes to tax-exempt retirement contributions. Other states tax contributions at the state level.

If retirement contributions are exempt from state income tax, Boxes 1 and 16 may be the same. If contributions are subject to state income tax, Box 16 may be higher than Box 1.

For example, Pennsylvania requires employees to pay state income tax on retirement contributions. On the other hand, Ohio aligns itself with federal requirements and exempts retirement contributions from state income tax. Check with your state for more information.

2. The employee participated in your adoption assistance program

If you have an adoption expense program at your small business, you pay or reimburse employees for qualifying expenses. Some adoption-related expenses include adoption fees, court costs and attorney fees, and travel expenses.

When you pay or reimburse an employee for qualifying adoption expenses, the employee’s W-2 Box 1 is likely higher than Box 3.

Adoption expense payments and reimbursements are exempt from federal income tax withholding but are subject to Social Security and Medicare taxes.

Report the amount of adoption assistance expenses on Form W-2 in Box 12. Use code “T” for adoption expense payments or reimbursements.

For example, you provide a reimbursement of $1,100 to cover an employee’s adoption expenses. The employee’s gross income is $65,000. Record $63,900 in Box 1 and $65,000 in Boxes 3 and 5.

3. The employee earned above the SS wage base

In some instances, Box 1 can be higher than Box 3. After an employee earns above the Social Security wage base, they no longer need to pay Social Security tax.

Because earnings above the Social Security wage base aren’t subject to SS tax, don’t report them in Box 3.

The 2023 Social Security wage base is $160,200.

Wages above the SS wage base are subject to federal income tax. As a result, continue listing the wages in Box 1.

Let’s say you pay an employee $170,000 in taxable wages in 2023. You would enter “$170,000” in Box 1 and “$160,200” in Box 3. Because there is no Medicare wage base, you must also report “$170,000” in Box 5.

Heads up! The 2024 Social Security wage base is increasing to $168,600 in 2024.

Example Form W-2 Box 1 “discrepancy”

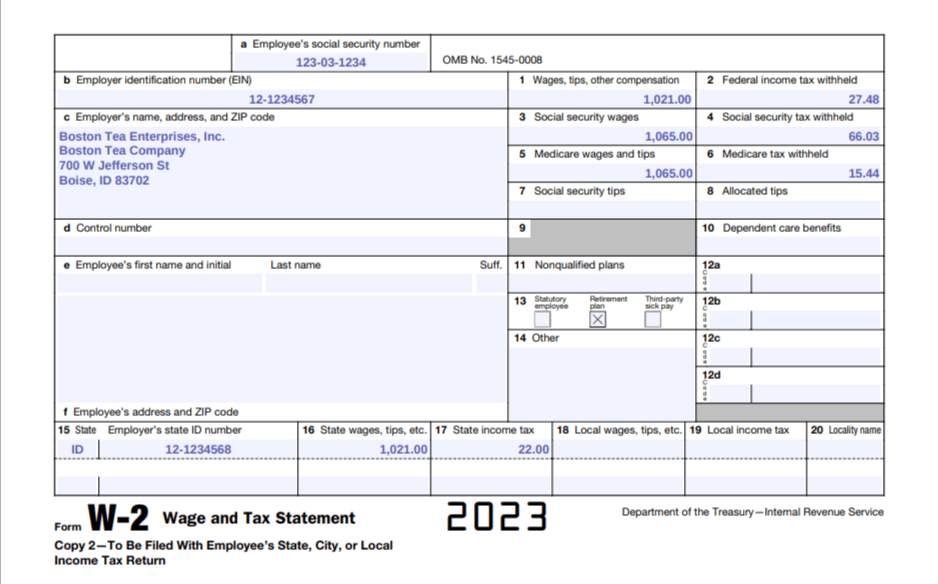

Take a look at this example Form W-2.

The value in Box 1 is lower than the values in Boxes 3 and 5. You can also see that there is a checkmark in Box 13.

This example Form W-2 shows that the employee contributed to a pre-tax retirement plan, reducing their taxable wages. However, the retirement contribution is still subject to Social Security and Medicare taxes.

Looking for a reliable provider to file Forms W-2 for you? Patriot Software’s Full Service payroll services will file Forms W-2 on your behalf. All you have to do is print out the employee copies for distribution. Get your free trial now!

This is not intended as legal advice; for more information, please click here.

This article has been updated from its original publication date of March 4, 2019.