Tired of how often you run payroll and pay employees? Before changing payroll frequency, there are a number of things to consider. Making this kind of change could do more than ruffle your employees’ feathers—it could land you in hot legal water.

Just look at the court case, Wilkinson v. W.Va State Office of Governor. A business changed its pay frequency … and the employees sued. But, the court ruled in favor of the business (and upheld the decision despite numerous appeals).

Why? Because the employer followed changing payroll frequency guidelines. Had the employer randomly made changes, the case might not have gone so well for them. And that is why knowing how to change pay frequency legally is so important.

Changing payroll frequency: Why?

When you have employees, you need to determine how often to pay them. Choosing a payroll frequency impacts how many times you run payroll and distribute wages. Common pay periods include:

- Weekly (52 paychecks per year)

- Biweekly (26 paychecks per year)

- Semimonthly (24 paychecks per year)

- Monthly (12 paychecks per year)

When you’re running a business, you regularly have to make decisions. Sometimes, you make the wrong choice for your company. If you pick a pay frequency that doesn’t work for your enterprise, you may want to change it up.

Here are some reasons why you might decide to change your small business’s pay frequency.

1. For better financial planning

Sometimes, the payroll method you choose messes up your cash flow projections—like if you run payroll using a biweekly frequency and forget about those three-paycheck months.

Under a biweekly frequency, you pay employees twice per month. However, there are two, three-paycheck months per year. Not being prepared for the third paycheck during those months can throw off your budget and create problems for your business.

If you have difficulty handling the months with the third paycheck, you may consider changing your payroll cycle to a more financially consistent method. For example, weekly, semimonthly, and monthly payrolls always have the same number of payrolls per month, making it easier to budget for some employers.

2. For consistency

A semimonthly payroll frequency can be more confusing than others. Semimonthly paydays don’t take place on the same day of the week.

When you use a semimonthly schedule, you pay employees on specific dates, but the days vary. For example, you might run payroll on the 15th and the last day of the month. Because the 15th and the last day of the month aren’t consistently on a Friday, paydays can be anytime during the week.

Inconsistent paydays can be challenging to keep track of for some small business owners. If the inconsistency causes you to be confused and disorganized, you may consider changing pay periods.

3. To handle employee changes

Sometimes, changing payroll frequency doesn’t affect all employees. When an employee’s position changes, you may need to change their pay frequency, too.

Some businesses pay employees using different pay periods, depending on whether they are hourly vs. salary.

For example, you might pay hourly workers using a monthly pay period and use a biweekly period for your salaried employees. If you transition an employee from hourly to salary, you must change your payroll frequency for that worker.

4. To comply with state laws

Another reason businesses change pay frequencies is that they have to. Although no federal law says how often you must pay employees, there are pay frequency requirements by state. And if you’re using a frequency that goes against your state’s law, you must replace it immediately.

Most states set pay frequency laws. The states with pay period laws set a minimum frequency you must use. And, laws may depend on other factors, such as occupation. Make sure to check with your state for more information on frequency laws.

Changing pay frequency: How

Once you’ve decided to change your payroll period, it’s time to make the switch. So, can employers change payroll schedule?

Yes, but changing your frequency also means changing payroll dates. So, do the following before running payroll under the new frequency.

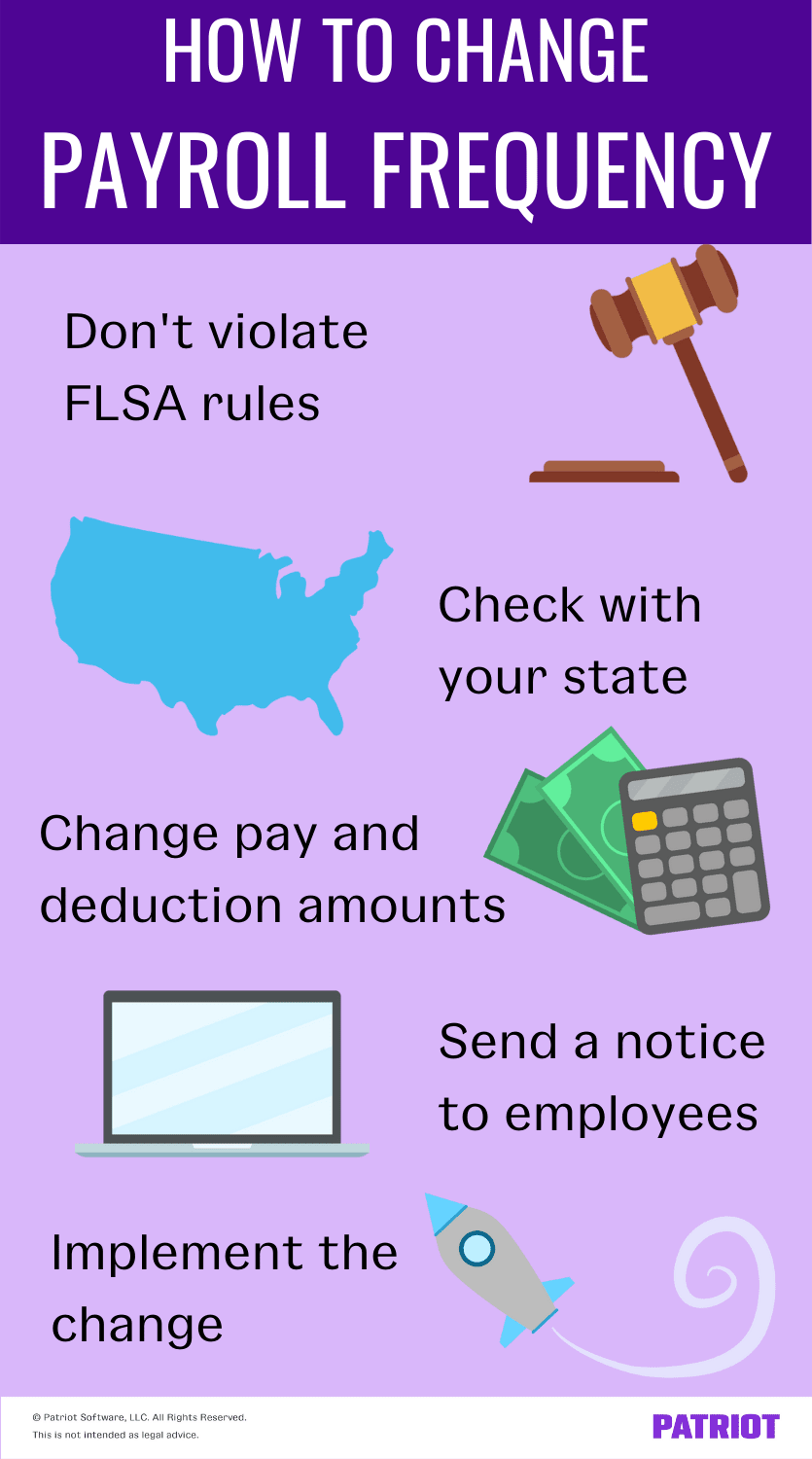

1. Don’t violate FLSA rules during the switch

When it comes to establishing a pay frequency, keep your periods consistent. So if you need to switch up the schedule you use, the last thing you want is to violate the Fair Labor Standards Act’s (FLSA) wage and hour laws (e.g., overtime rules)…

…Which is why you need to be sure:

- You have a legitimate business reason

- The change is permanent

- You are not avoiding overtime pay or minimum wage

- You don’t unreasonably delay payment of wages

2. Check with your state

Before changing your pay frequency, you need to ask yourself one key question: Can I? Check your state laws to make sure the frequency you want is allowed.

If your desired pay period goes against your state’s frequency requirements, select a different pay period. Or, keep the one you have.

3. Change pay and deduction amounts

When you switch your pay frequency, you’re changing the amount you pay your employees per paycheck. And, that changes the amount you withhold per pay period for taxes and other payroll deductions, like benefits or garnishments.

The annual amount you withhold for payroll deductions is the same for all pay frequencies. But, the amount you take out of your employee’s paycheck depends on how often you run payroll.

When changing payroll frequency, remember to increase or decrease the amount you withhold from employee wages.

For example, moving from a biweekly payroll to a weekly payroll means you withhold less in taxes per week because the employee earns less per pay period.

4. Send a pay frequency change notice to employees

Telling your employees about the frequency change is oh-so-important. Otherwise, you’ll need to deal with disgruntled employees wondering where their hard-earned wages are. And, failing to tell employees can disrupt their budgets.

Distribute a payroll frequency change letter well before implementing the new pay periods. That way, employees can adjust their finances and ensure they have enough money to cover bills and other expenses.

For example, you pay employees biweekly. If you decide to move to a monthly payroll without sending out a payroll frequency change letter, employees may not have enough funds to cover their expenses between paydays. So, send a change in pay frequency letter to give employees advance notice.

Also, keep records of your notifications (e.g., emails, dates you sent out letters, etc.). That way, you can retain proof that you told employees about the pay frequency change. You might even consider gathering employee signatures on the notification to ensure they read your notice.

5. Implement the change

Finally, you can implement the pay frequency change. How you establish the new frequency depends on how you run payroll.

If you have an accountant or bookkeeper who manages your payroll, notify them of the change in advance.

If you run payroll by hand, mark down the new frequency so you don’t forget. Then, whip out those calculators and adjust payroll withholdings.

If you use software to run payroll, enter the new frequency into the system. The software will automatically adjust tax withholdings based on the new pay period (yay!).

Save yourself the calculations that come with changing pay frequency. With Patriot’s online payroll software, you can pay employees as often as you want—without ever having to use your calculator to run payroll. And because we charge per employee, your pay frequency doesn’t determine how much you pay. Get your free trial today!

This article has been updated from its original publication date of October 17, 2018.

This is not intended as legal advice; for more information, please click here.