Do you need to withhold money from employee wages beyond taxes (e.g., garnishments or benefits)? Then you might be wondering when exactly you deduct the employee’s contributions—before or after taxes. Well, it depends. For accurate withholding, understand what are pre-tax deductions.

Not sure what that means or how it impacts your tax calculations? We’ve got you covered.

What are pre-tax deductions?

A pre-tax deduction is money you remove from an employee’s wages before you withhold money for taxes, lowering their taxable income. Pre-tax deductions go toward employee benefits. Not all benefits are pre-tax deductions.

Many benefits are employee- and employer-sponsored, meaning both parties contribute to whatever premium, account, or program the employee has. But when you deduct the employee’s contribution from their wages, you do it either before or after taxes, depending on the type of benefit.

If you offer a range of employees benefits, chances are you’ll come across a pre-tax deduction. And, you’ll likely come across post-tax deductions, which are benefits you withhold after taxes.

Unlike post-tax deductions, pre-tax deductions benefit employees in more ways than one. Employees get to enjoy the benefit and reduce the amount of money they owe in taxes. Not to mention, employers also enjoy a tax reduction.

How do pre-tax deductions impact taxes?

Again, pre-tax deductions reduce an employee’s taxable wages. This often gives employees more spending money.

So, which taxes does a pre-tax deduction reduce? Pre-tax deductions can reduce an employee’s federal, state, and local taxes:

- Federal income tax

- FICA tax (Social Security and Medicare taxes)

- State income tax (if applicable)

- Local income tax (if applicable)

Pre-tax payroll deductions also lower federal unemployment tax (FUTA tax), which only employers pay. And, these deductions can lower state unemployment tax, which only employers pay (with some state exceptions).

Keep in mind that not all pre-tax deductions are completely tax free. Some deductions are exempt from federal income tax but not from FICA and FUTA taxes.

Example

Say you have an employee with a pre-tax deduction. The deduction is $50 per payroll, and you pay the employee a gross pay of $1,000 per biweekly pay period.

First, subtract the $50 pre-tax withholding from the employee’s gross pay ($1,000):

$1,000 – $50 = $950

The employee’s taxable income is $950 for the pay period. You can now withhold taxes on $950 rather than $1,000.

Future taxation

Even though there is no tax now, employees might owe taxes on pre-tax benefits later, like when they go to use the benefit.

For example, an employee has a pre-tax retirement account. You withhold the money before taxes and deposit it into the account. When the employee retires and uses the saved funds, they will owe taxes on the amount.

Limits

Some benefit deductions are only pre-tax up to a certain amount. This means that the deduction is exempt from taxation until the employee reaches an IRS contribution or tax-exempt limit. The IRS limit for each type of pre-tax deduction with a threshold is subject to change annually.

For example, health savings account deductions have an annual IRS contribution limit that’s exempt from taxes.

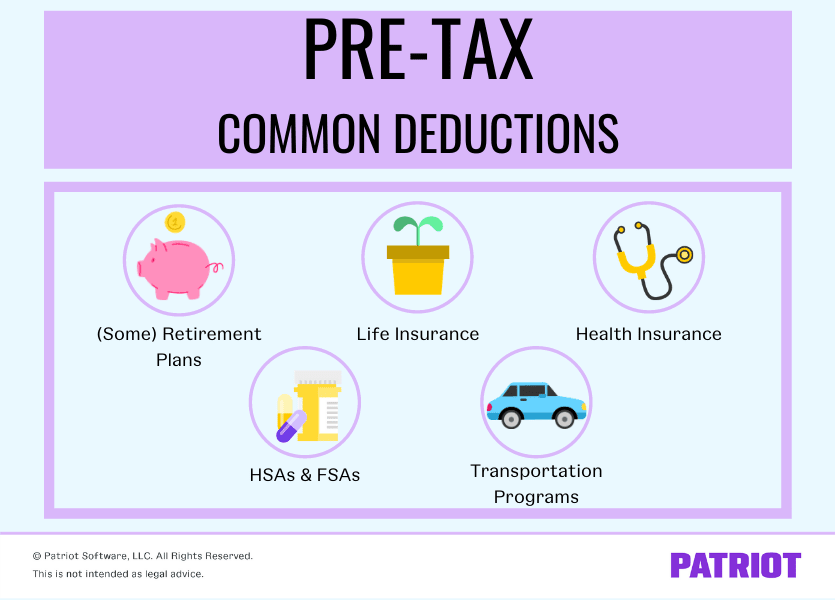

Pre-tax deductions list

So, what deductions are pre-tax? A number of fringe benefits allow pre-tax deductions. Below is a pre-tax deductions list of common employee benefits.

Retirement plan contributions

Some retirement plans are eligible for pre-tax deductions, such as certain IRAs and 401(k) plan types. This lets employees save for retirement and reduce their taxable income.

Pre-tax retirement accounts are typically exempt from all employment taxes. Check the specific plan you offer for more details.

Retirement plans have IRS contribution requirements and limits that change annually. There is an additional contribution limit for workers over a certain age.

Although some retirement plans are pre-tax deductions, employees must pay the taxes when they receive distributions.

Keep in mind that not all retirement plans are pre-tax. Roth IRA and Roth 401(k) contributions are post-tax deductions. This requires employees to pay taxes on them before you withhold them. However, the employee does not owe taxes on distributions.

Health insurance premiums

You might be able to withhold health insurance premiums before taxes, especially if the health benefits are part of a Section 125 plan.

Common pre-tax health-related insurance benefits include:

- Health insurance

- Accident insurance

- Dental insurance

- Vision insurance

For the most part, health benefits are pre-tax. Some health benefits have contribution limits or special tax withholding rules.

HSA and FSA contributions

Do your employees contribute to a health savings account (HSA) or flexible spending account (FSA)? If so, their contributions are pre-tax deductions.

Both HSAs and FSAs are accounts employees can contribute to and use to fund qualifying medical expenses, such as copays and deductions. These accounts help employees to save for medical expenses insurance doesn’t cover and reduce their taxable income.

The IRS sets an annual contribution limit for an HSA and FSA. Like retirement plans, individuals above a certain age can contribute more to their account.

Life insurance premiums

Group-term life insurance is exempt from all employment taxes. However, it is only exempt from FICA taxes up to the cost of $50,000 of coverage.

Premiums must go toward life insurance that:

- Provides a general death benefit

- Is provided to a group of at least 10 full-time employees

- The employer carries, either directly or indirectly

Transportation program contributions

Transportation, or commuter, benefits are pre-tax deductions that can cover an employee’s transportation-related expenses.

Qualifying transportation expenses include:

- Transit passes for public transportation (e.g., buses, trains, subways, etc.)

- Parking expenses (e.g., parking at or near work)

Depending on the types of commuter benefits you offer, there might be limits. Once the benefit reaches that limit, it is no longer exempt from taxes.

Don’t calculate pre-tax deductions yourself. Patriot Software’s online payroll will do all the calculations for you—with guaranteed accuracy. Start your free trial now.

This article has been updated from its original publication date of 4/25/2012.

This is not intended as legal advice; for more information, please click here.