Payroll Services, Simplified for You

Payroll calculations + tax filings and deposits

See a Demo Create Account 30 Days Free!

Full Service Employee Payroll only $37/month+ $4 per employee (or 1099 contractor)

You Run the Payroll. We’ll Handle the Tax Filings & Deposits.

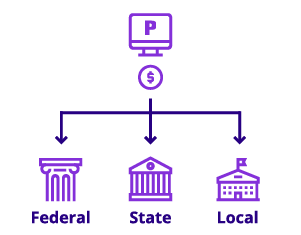

Run payroll and pay employees using our simple 3-step process. Patriot’s online payroll services will then deposit your payroll taxes and file the appropriate forms with federal, state, and local agencies, giving you more time to focus on your business.

Patriot’s Online Payroll Services Features

- Free USA-based support

- Free payroll setup

- Free 2-day direct deposit for qualifying customers

- Free employee portalWatch Video (0:17 seconds)

- Free workers' comp integration

- Free 401k integration

- Unlimited payrolls

- On-the-fly Pay Rate ChangesWatch Video (0:47 seconds)

- All pay frequenciesWatch Video (0:15 seconds)

- Multiple locationsWatch Video (0:19 seconds)

- Customizable hours, money, deductionsWatch Video (0:18 seconds)

- Mobile friendlyWatch Video (0:14 seconds)

- Accounting Software integrationWatch Video (0:18 seconds)

- Electronic or printable W-2sWatch Video (0:17 seconds)

- Time-off accrualsWatch Video (0:16 seconds)

- Multiple pay ratesWatch Video (0:17 seconds)

- Repeating, additional money typesWatch Video (0:14 seconds)

- Paying contractors in payrollWatch Video (0:24 seconds)

- Free contractor portal(Currently in Beta)

- DepartmentsWatch Video (0:20 seconds)

- Unlimited users with permissionsWatch Video (0:20 seconds)

- Time and Attendance integrationWatch Video (0:28 seconds)

- HR integration

- Optional 1099 e-Filing

- Net to Gross Payroll tool

- We'll file and deposit federal payroll taxes

- We'll file and deposit state payroll taxes

- We'll file and deposit local payroll taxes

- We'll file year-end payroll tax filings (no additional fees)

- Tax filing accuracy guaranteed

Add-on Features

HR Features

- Maintain paperless employee files

- Manage documents online

- Easy reporting

- Employee information tracking

- Designate managers

- Assign direct reports

Time & Attendance Features

- Easy timekeeping for your hourly or salary employees

- Employees securely clock-in with their employee portal

- Create custom overtime rules

- Easily view used and unused employee time-off

Trusted by Tens of Thousands!

Businesses rely on Patriot to streamline their payroll.

Lots of Payroll Reports ... with filtering, sorting, and exporting capabilities.

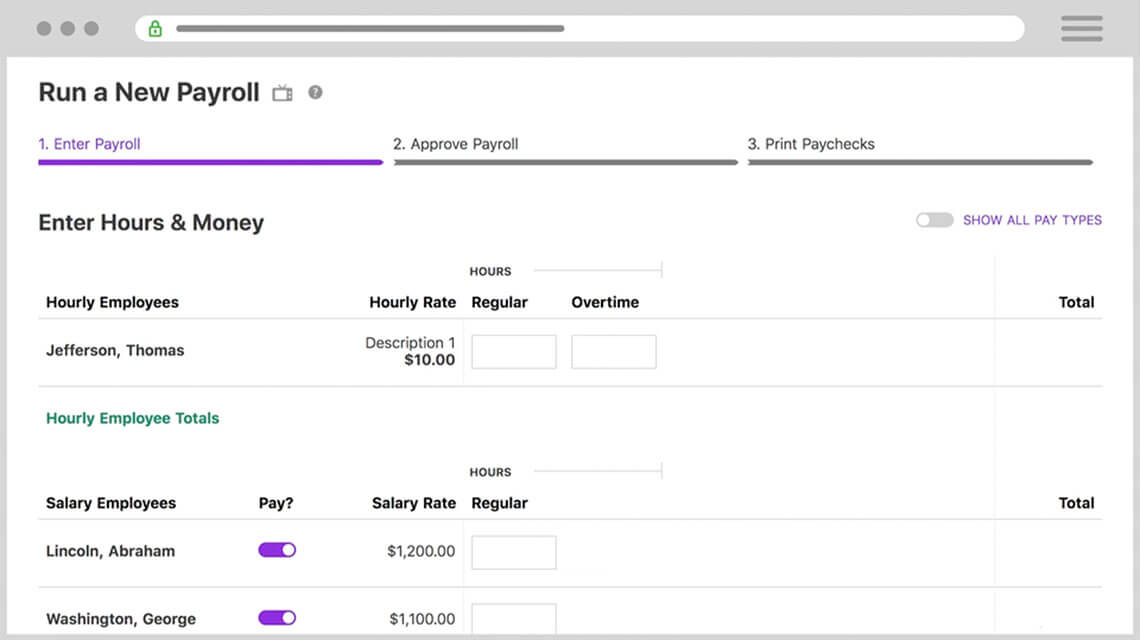

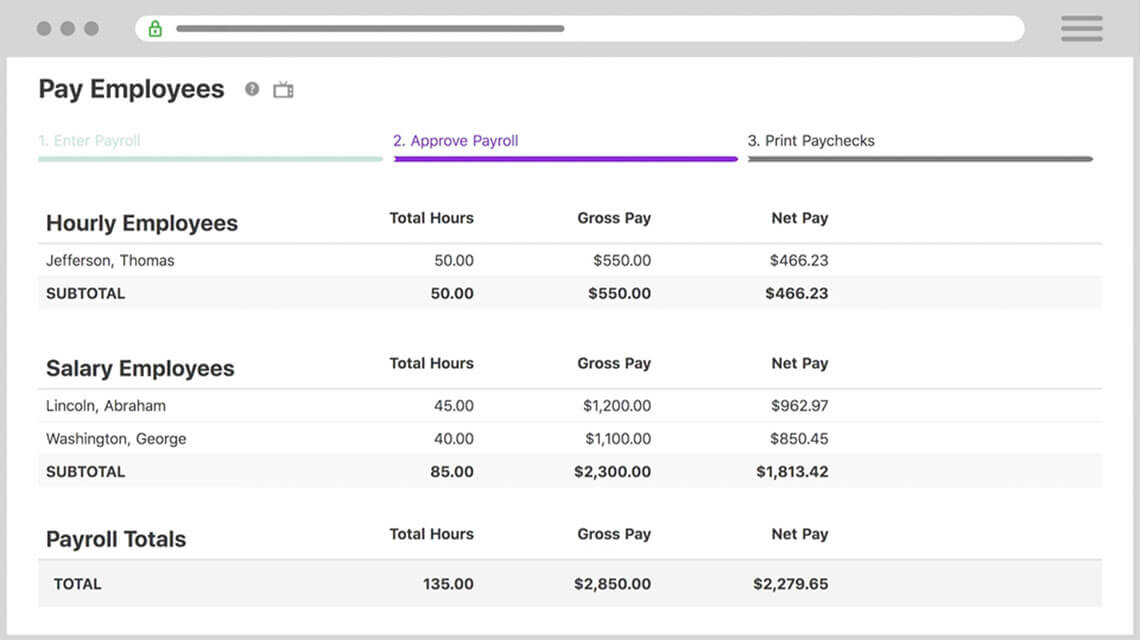

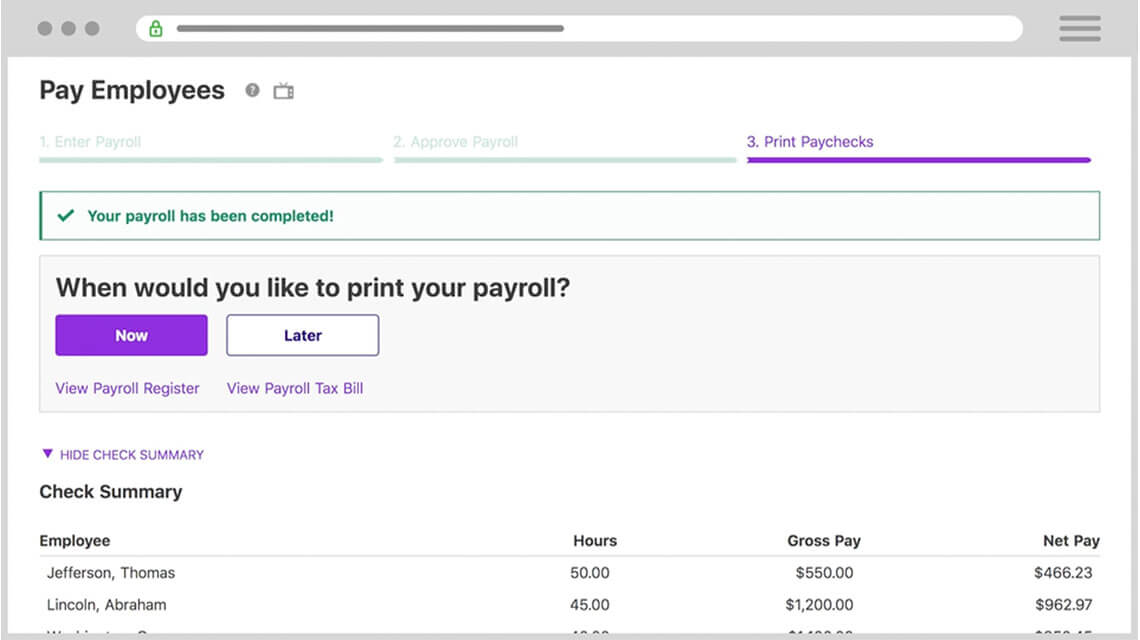

Run Payroll in Under 3 Minutes

Our customers average less than 3 minutes.

Get the Payroll Software That Tops the Charts for Best Customer Support, Ease of Use, and Value

Payroll Service FAQs

You got questions? We got answers!

Our Full Payroll Service is perfect for small businesses in the USA and handles all employee taxes and most of the employer taxes, including federal, state and local taxes. We do not handle household employers (Schedule H).

Yes, we file in all 50 states. However, there is a $12 fee for each additional state that we file in.

Patriot collects and files workers' compensation insurance for Washington and Wyoming. For other states, we do offer free integration with AP Intego, who offers Pay-As-You-Go Workers’ Compensation Insurance.

No. While you can set up custom deductions and contributions, Patriot Software, DOES NOT handle the remitting of these funds to the proper agencies at this time.

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date. If payroll is run on the same day as the pay date, payroll taxes will be collected on the next available banking day.

Payroll Overview

Yes. You may run a payroll whenever you need to in the payroll software.

No–our software is only available to companies with employees working in the USA. It’s our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

Yes. You may begin using the payroll application at any time during the year. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W-2s are accurate. (We can help! We offer free payroll setup to help you get your account set up and can enter all payroll history for you.)

Pricing & Billing

In the months you don’t run payroll, you will only be charged the base price for the payroll.

There’s no additional software charge for providing direct deposit to your employees.

Patriot Software accepts credit or debit cards from Visa, Mastercard, American Express, and Discover for your software and service fees.

Direct Deposit

We will only accept applications from small business owners using a commercial/business bank account for their payroll.

Patriot offers a few direct deposit options to meet our customers' needs: free, expedited 2-day direct deposit for qualifying customers; standard 4-day direct deposit; and payroll prefunding. Your money will be ACH debited from your bank after you run payroll.

Technical

Since our payroll software is online, you only need access to a web browser and the Internet. There’s no software to download.

When building solutions, they are designed to be highly secure, performant, and scalable. Solutions are built on a cloud provider giving us the ability to quickly respond to outages and threats. Patriot Security & Systems Team is notified immediately when monitoring systems detect abnormal activity.

We utilize a diverse set of technologies to safeguard your data. Policies are implemented to ensure that these technologies are properly installed and maintained. Third-party audits are conducted to verify we meet industry standards.

Full Service Payroll

Our Full Service is perfect for small to large businesses in the USA and handles all employee taxes and most employer taxes, including federal, state, and local taxes.

Patriot collects and files Workers’ Compensation Insurance for Washington and Wyoming. For other states, we do offer free integration with NEXT Insurance, who offers Pay-As-You-Go Workers’ Compensation Insurance.

Yes, we file in all 50 states. However, there is a $12 fee for each additional state that we file in.

Unfortunately, we don’t handle the IRS Form 943 at this time. However, it’s on our radar, and we look to offer this sometime in the near future!

No. While you can set up custom deductions and contributions, Patriot Software does not handle the remitting of these funds to the proper agencies at this time. However, it’s on our radar, and we look to offer this sometime in the near future!

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date. If payroll is run on the same day as the pay date, payroll taxes will be collected on the next available banking day.