Minimum wage law prevents employers from paying employees below a certain amount per hour. There is a federal minimum wage, but many states and localities set a higher wage for employers to follow. To ensure your business is compliant with labor laws, read on to learn what is minimum wage.

What is minimum wage?

The minimum wage is the lowest amount you can legally pay an employee per hour of work. You can pay more than the minimum wage if you’d like, but you cannot pay less than the minimum wage.

Minimum wage laws do not apply to independent contractors, so it’s crucial to make sure that you classify your employees correctly.

Who sets the minimum wage?

The federal government sets a standard minimum wage that applies to all employees in the United States. However, states and localities can set minimum wage rates, too.

So, which rate do you need to follow? Federal, state, or local?

Federal minimum wage vs. state vs. local

What happens if a state’s minimum wage is lower than the federal minimum wage? What about if the local minimum wage is lower than the federal?

If the state or local minimum wage is lower than the federal minimum wage, you must pay your employees at least the federal minimum wage rate.

What about if the state or local minimum wage is higher? If the state or local minimum wage is higher than the federal rate, pay your employees the state or local rate (whichever is higher).

Pro tip: When choosing between federal, state, and local minimum wage laws, always pay your employees the highest rate.

What is the federal minimum wage?

The federal minimum wage is set by the Fair Labor Standards Act (FLSA) and enforced by the U.S. Department of Labor (DOL).

Although the federal minimum wage rate is subject to change, it has not increased since 2009.

So, what is the national minimum wage? The current federal minimum wage is $7.25 per hour. However, the federal minimum wage could potentially increase in upcoming years.

Minimum wage by state

Each state can set its own minimum wage. If a state’s minimum wage is greater than the federal minimum, pay employees at least the state’s minimum wage.

For example, the minimum rate in Ohio is $10.45 per hour for 2024. If you have employees in Ohio, you must pay them at least the state’s minimum since it is greater than the federal minimum wage of $7.25.

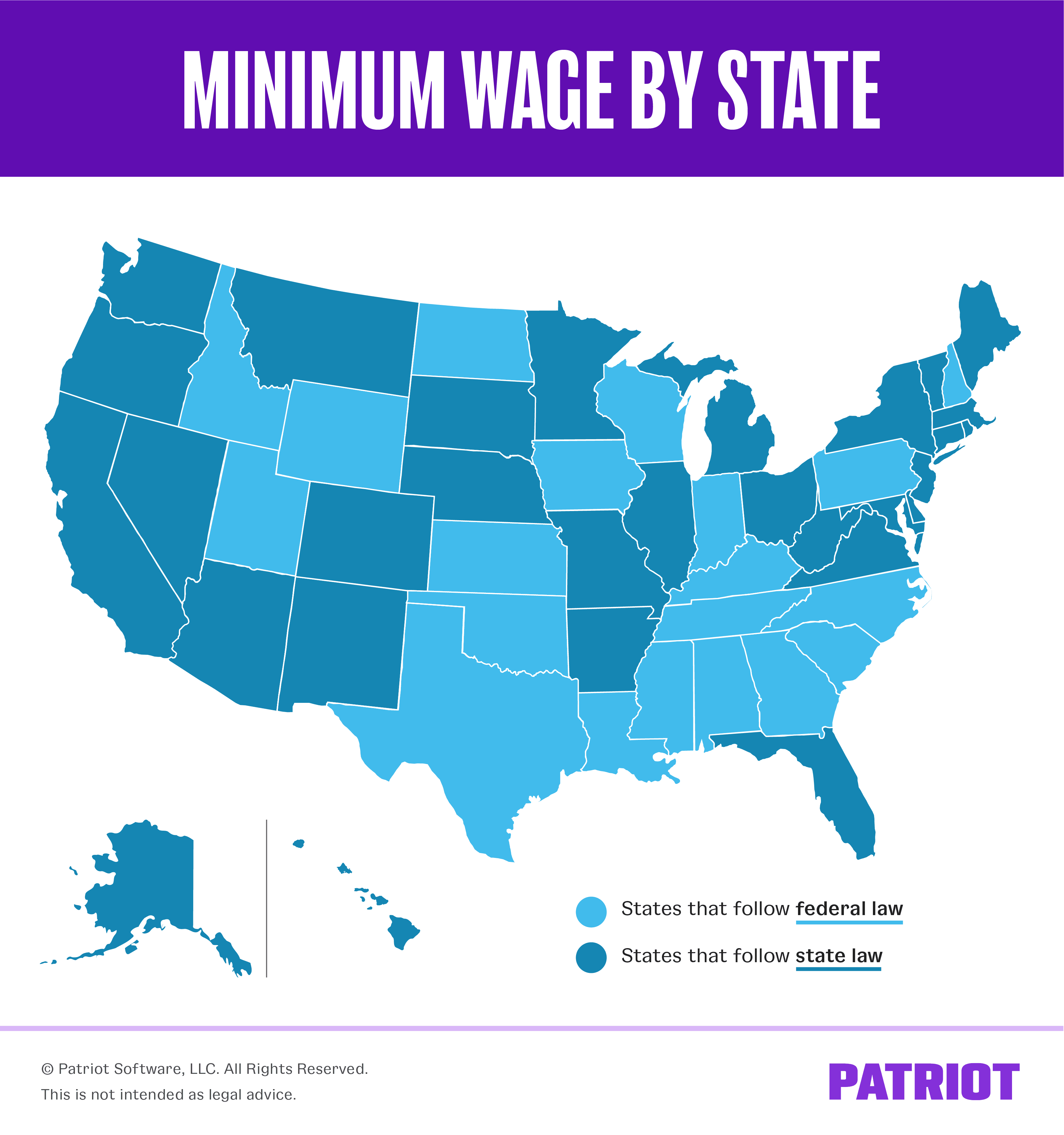

Use the map below to see which states follow the federal minimum wage rate and which set their own minimum.

You might be wondering how much minimum wage is in your state. Check out our state-by-state minimum wage rate chart below to find out. Keep in mind that the states with $7.25 follow the federal minimum wage base.

[State minimum wages as of January 1, 2024]

| State | State Minimum Wage (2024) |

|---|---|

| Alabama* | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11.00 |

| California | $16.00 $20.00 for fast food restaurant employees covered by California’s Fast Food Minimum Wage law |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| D.C. | $17.05 (increases to $17.50 on July 1, 2024) |

| Delaware | $13.25 |

| Florida | $12.00 (increases to $13.00 on September 30, 2024) |

| Georgia** | $7.25 ($5.15 for employers not covered by the Fair Labor Standards Act) |

| Hawaii | $14.00 |

| Idaho | $7.25 |

| Illinois | $14.00 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana* | $7.25 |

| Maine | $14.15 |

| Maryland | $15.00 |

| Massachusetts | $15.00 |

| Michigan | $10.33 |

| Minnesota | $10.85 (employers with gross revenue > $500,000) $8.85 (employers with gross revenue < $500,000) |

| Mississippi* | $7.25 |

| Missouri | $12.30 |

| Montana | $10.30 |

| Nebraska | $12.00 |

| Nevada | $10.25 (if the employee is offered qualifying health benefits) $11.25 (if the employee isn’t offered qualifying health benefits) After July 1, 2024: $12.00 for all employees |

| New Hampshire | $7.25 |

| New Jersey | $15.13 (employers with > 6 employees) $13.73 (seasonal and employers with < 6 employees) |

| New Mexico | $12.00 |

| New York | $15.00 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.20 (subject to change July 1, 2024) |

| Pennsylvania | $7.25 |

| Rhode Island | $14.00 |

| South Carolina* | $7.25 |

| South Dakota | $11.20 |

| Tennessee* | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12.00 |

| Washington | $16.28 |

| West Virginia | $8.75 ($7.25 for employers with less than six nonexempt employees working at any one separate, distinct, and permanent work location) |

| Wisconsin | $7.25 |

| Wyoming** | $7.25 ($5.15 for employers not covered by the Fair Labor Standards Act) |

*These states do not have a state-mandated minimum wage. Instead, most employers must pay the federal minimum wage.

**These states have a minimum wage of $5.15 for any employers who are not covered by the Fair Labor Standards Act. Most employers are covered by the FLSA and must pay the federal minimum wage of $7.25.

Heads up! State minimum wage laws are ever-changing. Stay up-to-date with your state’s minimum wage requirements by periodically checking your state’s website.

Local minimum wage

Some cities and counties create a local minimum wage that differs from state or federal rates. Local wages are most common in bigger cities. Employers must pay the higher of the two rates if the local minimum wage is different from the state minimum wage.

For example, the minimum wage in San Francisco is $18.07 per hour (as of July 1, 2023). Employers in San Francisco must pay employees at least the local base wage because it is greater than both the state and federal minimums.

Another example is New York. Employers in most of the state must pay an hourly minimum wage of $15.00 per hour. However, the minimum wage in Long Island, Westchester, and NYC is $16.00 per hour.

Like state minimum wage rates, local rates are subject to change. Check with your local government for more information.

Exceptions to minimum wage

There are some exceptions to paying your employees minimum wage. Minimum wage varies for:

- Tipped workers

- Youth

Minimum wage for tipped employees

The FLSA currently permits a tip credit, which reduces the federal minimum wage for tipped employees. Tipped employees can have a lower base wage because their tips should make up the rest of their wages.

The federal tipped minimum wage is currently $2.13. This applies to employees who earn more than $30 in tips per month.

Individual states can also have minimum wage laws for tipped employees. Check your state’s tipped minimum wage laws to learn more.

Youth minimum wage

The FLSA also permits a special youth minimum wage. You can pay employees under age 20 a wage of $4.25 for the first 90 days of employment. After 90 consecutive days of employment or the employee reaches 20 years of age (whichever comes first), the employee must receive the minimum wage.

Some states have a youth minimum that is greater than the federal youth minimum wage. For more information, check out the U.S. Department of Labor’s website.

Living wage vs. minimum wage

When looking through state and local minimum wage laws, you may see the term “living wage.” So, what is a living wage?

A living wage is a state or local wage that’s higher than the minimum wage. Similar to cost of living, the living wage is the amount an employer would need to pay an employee to avoid poverty. The goal of a living wage is to decrease poverty through increased earnings.

This article has been updated from its original publication date of March 22, 2012.

This is not intended as legal advice; for more information, please click here.