If you have a veteran-owned small business, you may be eligible for special training, loans, and contracting opportunities. Read on to learn what types of options are available to veteran entrepreneurs as well as eligibility requirements.

And if you don’t have a veteran-owned business, you might qualify for support if you employ workers with veteran status. Scroll to the end to learn more.

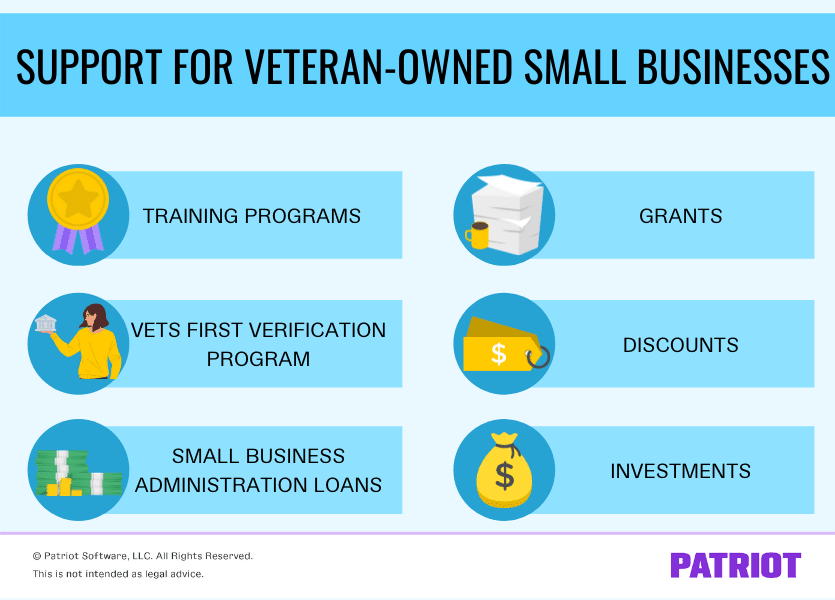

Support for veteran-owned small business

From entrepreneurial training to veteran business grants, see what kind of support you might be eligible for.

Training programs

There are a number of training programs exclusively available to veteran entrepreneurs. These programs provide entrepreneurship and management training to help you get your business idea off the ground.

Veteran-owned small business training programs walk you through core startup requirements like:

- Writing a business plan

- Managing a small business

- Marketing a company

- Financing a venture

Many of these training programs are offered through the SBA (Small Business Administration) and their partners. Some popular veteran training programs include:

- Boots to Business (B2B)

- Entrepreneurship Bootcamp for Veterans (EBV)

- Veteran Women Igniting the Spirit of Entrepreneurship (V-WISE)

- National Veterans Entrepreneurship Program (VEP)

Vets First Verification Program

Qualifying veteran-owned companies can register through the Vets First Verification Program.

There are a number of veteran-owned business benefits for companies that join the Vets First Verification Program, such as:

- Set-aside government contracts

- Tax relief

- Capital access

To be part of the Vets First Verification Program, you must register as a Veteran-Owned Small Business (VOSB) or a Service-Disabled Veteran-Owned Small Business (SDVOSB).

Both the VOSB and the SDVOSB define a veteran as someone who either:

- Served on active duty with the Army, Air Force, Navy, Marine Corps, or Coast Guard and didn’t receive a dishonorable discharge

- Served as a Reservist or member of the National Guard and was called to federal active duty or disabled from a disease or injury that began while serving or training or got worse

You can apply for the Vets First Verification Program online through the U.S. Department of Veterans Affairs. Read about both programs to determine if you qualify.

Veteran-Owned Small Business

If you or another owner in your business qualifies as a veteran, you may be able to register your business as a VOSB.

To qualify for the VOSB program, you must meet all of the following requirements:

- Be a veteran

- Own 51% or more of the business

- Have full control over day-to-day management, decision-making, and strategic policy

- Have managerial experience

- Be the highest-paid person (if you’re not, write a statement explaining why taking a lower pay helps the business)

- Work full-time in the business

- Hold the highest officer position

Service-Disabled Veteran-Owned Small Business

If you have a service-related disability, you may be eligible to register your business as a Service-Disabled Veteran-Owned Small Business.

To qualify for the SDVOSB program, you must meet all of the VA’s requirements. You (or another owner in your company) must:

- Be a veteran

- Own 51% or more of the business

- Have full control over day-to-day management, decision-making, and strategic policy

- Have managerial experience

- Be the highest-paid person (if you’re not, write a statement explaining why taking a lower pay helps the business)

- Work full-time in the business

- Hold the highest officer position

- Either have a disability rating letter from the VA stating that you have a service-related disability OR receive a disability determination from the Department of Defense

Additionally, the SBA has a Service-Disabled Veteran-Owned Small Businesses program. This program is not the same as the Vets First Verification Program.

To qualify for the SBA’s disabled veterans business program, your business must:

- Meet the SBA’s small business size standards

- Be at least 51% owned and controlled by at least one or more service-disabled veterans (i.e., a veteran with a service-connected disability)

- Be managed by one or more service-disabled veterans who handle day-to-day operations and long-term decision-making

SBA loan

If you are called-up to active duty and have to leave your small business, you may qualify for the SBA’s Military Reservist Economic Injury Disaster Loan (MREIDL) program.

As an essential employee in your small business, your company may not be able to operate normally until you return. This veteran business loan could help you cover your business’s operating expenses until then.

Under the MREIDL program, qualifying businesses can take out loans of up to $2 million.

Remember that this is a loan and not free money. An MREIDL has an interest rate of 4% and a maximum loan term of 30 years. If you take out a loan over $50,000, you need collateral.

You can learn more about the Military Reservist Economic Injury Disaster Loan program on the SBA’s website.

Additional opportunities

In addition to the support available through the SBA and the U.S. Department of Veterans Affairs, there are a number of resources from private companies.

These resources may come in the form of veteran-specific:

- Loans

- Investments (e.g., small business angel investors)

- Discounts

- Grants

- Training

Consider doing some research on the many opportunities out there available to veteran-owned small companies.

Don’t have a veteran-owned business?

If you or your business partners are not veterans, you might still qualify for government support in the form of an SBA loan. How?

The SBA’s Military Reservist Economic Injury Disaster Loan program is available to businesses whose essential employees are called-up to active duty. Generally, an essential employee is anyone whose work is critical to business operations.

You may qualify for the MREIDL program if the essential employee’s absence prevents you from meeting your operating expense obligations.

Keep in mind that you may have additional VETS reporting responsibilities if you employ veteran employees.

With the right tools, managing your books doesn’t have to be painful. Patriot’s accounting software makes it easy to track and manage your business’s money. Start your free trial to see what it can do for you!

This is not intended as legal advice; for more information, please click here.