Thinking about offering your employees a 401(k) plan? Already offer a retirement plan to your team? Either way, you’ll want all of the juicy details about the 401(k) tax credits for employers. Get the scoop on the 401(k) tax credit and how you can use it to lower your tax liability.

How tax credits work

A tax credit is a dollar-for-dollar amount businesses can use to reduce their tax liability. The credits directly lower what you owe in taxes. How much it lowers in taxes depends on the amount of the credit.

Say you have $50,000 of taxable business income. A $1,000 tax credit would directly lower your tax bill by $1,000.

Only eligible businesses or individuals can take advantage of certain tax credits. This means that you must meet specific requirements to get the tax credit.

Tax credits can incentivize business owners to add benefits to their business for employees and the work environment.

401(k) tax credits for employers

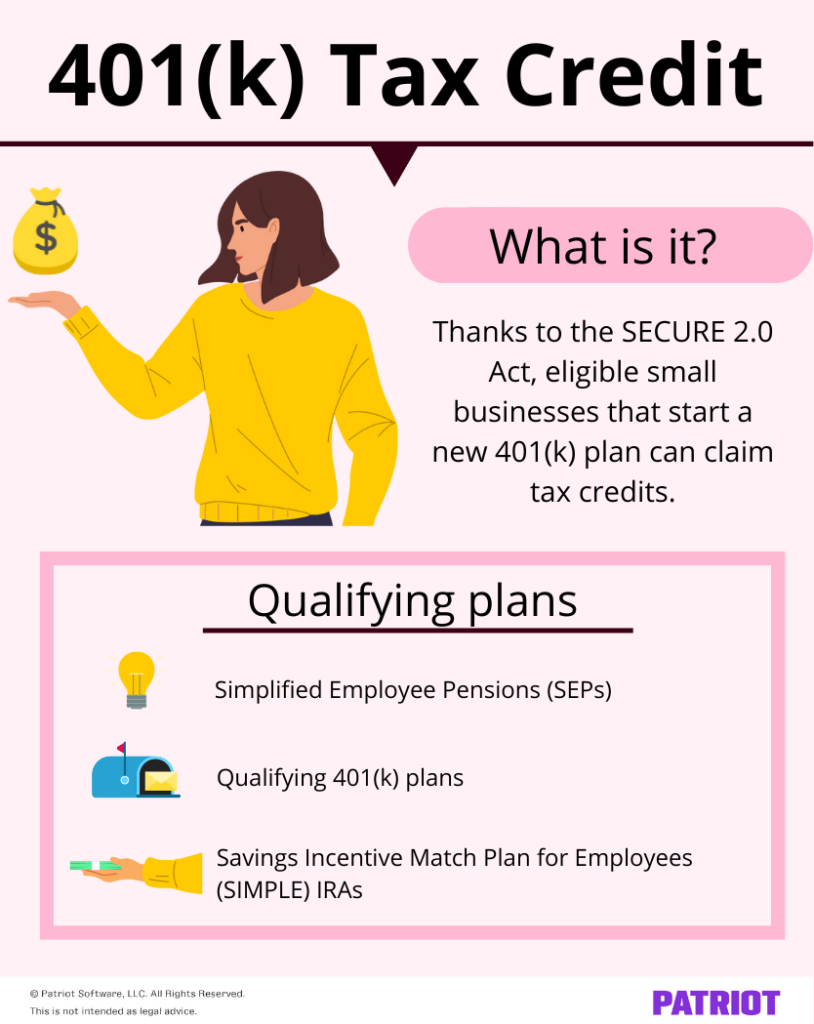

Some businesses may be eligible for a 401(k) tax credit, with a special thanks to the new SECURE Act 2.0. Is yours? Keep reading below to learn about tax credit for 401(k).

SECURE Act 2.0 401(k) tax credits

The Setting Every Community Up for Retirement Enhancement (SECURE) Act offered a number of advantages for employers who offer a retirement plan and for employees who participate. The act was signed into law in 2019 and created enhanced tax credits for small businesses that start a new 401(k) plan and/or add an automatic enrollment feature to any plan.

An improved version of the act, SECURE 2.0, was signed into law December 2022 that enhances the previous bill. While some provisions of the new bill went into effect on January 1, 2023, some won’t take effect for a few years.

The act incentivizes employers to start a 401(k) plan for their employees by offering 401(k) tax credits and expands retirement savings. And in turn, lowers a company’s tax liability.

| Looking to start a new 401(k) plan? It just got easier. Patriot has partnered with Vestwell, a retirement platform trusted by small businesses across all 50 states, to offer payroll with seamless 401(k) integration. Learn more about the upcoming integration by signing up here. |

How much is the SECURE Act 2.0’s 401(k) tax credits?

SECURE 2.0 provides tax credits for:

- Administrative costs

- Employers with 50 or fewer employees can claim a 100% tax credit to cover administrative costs up to $5,000 of establishing a retirement plan.

- Employers with 51 to 100 employees can claim a tax credit that covers 50% of administrative costs up to $5,000.

- Contribution costs

- Companies with up to 100 employees may be eligible for a tax credit if they contribute to an employee’s retirement savings.

- Businesses with 50 or fewer employees can claim a credit to cover up to $1,000 of contributions per employee.

- For employers with more than 50 employees, the tax credit limit is phased down over five years.

- Military spouse coverage

- Employers with fewer than 100 employees can receive a credit of up to $500 for offering certain retirement plans to military spouses.

Which plans qualify for the credit?

Simplified Employee Pensions (SEPs), qualified 401(k) plans, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs qualify.

Where can I find more information on the retirement plan tax credit?

You can find out more information about SECURE 2.0 by checking out the bill.

You can also use a 401(k) tax credit calculator to help compute how much your business’s credit may be.

To learn more about the original 401(k) tax credits, check out the IRS’s website.

Other tax credits for business owners

There are plenty of business tax credits that your company may be eligible for. So, what are they, you ask? Let’s take a quick look at some other tax credits your company may be able to take advantage of:

- Small employer health insurance tax credit

- Employers who enroll in a Small Business Health Options Program (SHOP) plan may be eligible for the small business health care tax credit if they have fewer than 25 full-time equivalent employees who pay at least 50% of employee premiums.

- Paid family and medical leave tax credit

- Employers must voluntarily offer paid FMLA leave to all eligible employees, pay at least 50% of the employee’s wages, provide at least two weeks of paid FMLA to full-time employees, and have a written policy in place.

- Disabled access credit

- An employer must have gross receipts below $1 million and 30 or fewer full-time employees.

- Work opportunity credit

- An employer might be eligible if they hire individuals from qualifying groups who have faced employment barriers (e.g., veterans, ex-felons, etc.).

- Employee retention credit

- Employers must continue to pay an employee’s wages despite not being able to operate their business due to disaster damage to qualify.

- Credit for employer-provided childcare facilities and services

- Employers who pay for certain childcare facilities and resource and referral expenses may be eligible for this credit.

Not sure about which tax credits you’re eligible for? Do some research, talk with a tax professional, or consult the IRS for more information.

This is not intended as legal advice; for more information, please click here.