Payroll software makes paying employees a breeze by calculating federal, state, and local taxes. If you’ve decided you want to use software to run payroll, you can put away your calculator and income tax withholding tables (hooray!). But, do you know how to choose a payroll service?

There are several payroll software providers on the market. If you’re new to payroll, you might not be sure what you’re looking for, which makes choosing a payroll system seem impossible.

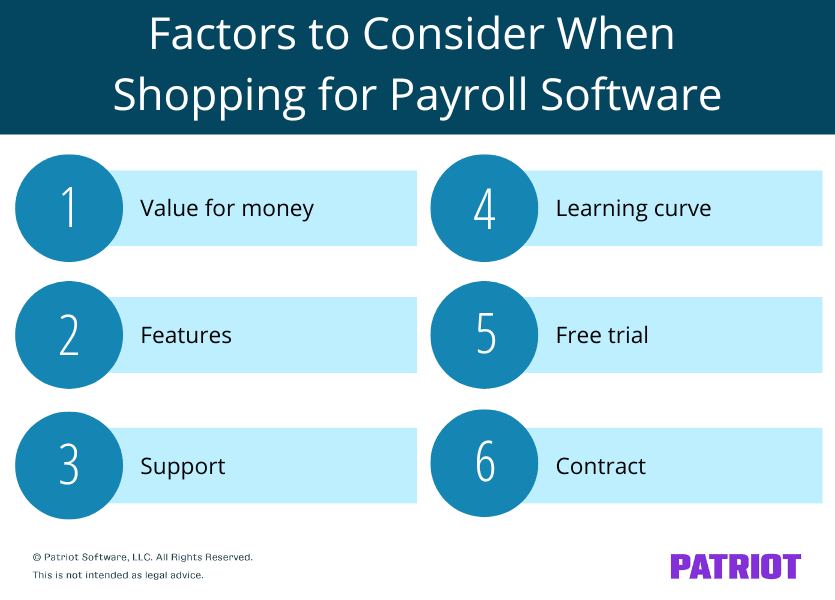

Don’t worry—choosing a payroll system can be easier than you think if you pay attention to factors. Read on to learn how to pick the best payroll software for small business.

How to choose a payroll service

Using payroll software can save you time and money so you can focus on growing your business.

You don’t need to be a payroll expert to use payroll software, but you do need to purchase a system that meets your business’s unique needs. The following eight factors will help you learn how to choose a payroll service.

1. Value for money

How much does a payroll service cost? You probably don’t want to dole out huge sums of cash on a non-revenue generating process like running payroll. You want a system that’s affordable and gets the job done.

More than “cost,” you want to look at the “best value for your money.” Your payroll software should be the perfect balance of cost and quality.

Cost may increase as you need more features. For example, you need full-service payroll if you want a payroll system to file and remit federal, state, and local payroll taxes. In addition to the monthly software fee, most providers charge a fee per employee or contractor.

Some systems have extra fees, like a charge per payroll run. Look for providers that let you run “unlimited payrolls” if you want to avoid these extra fees. Read the fine print to understand what the price includes.

2. Features

Though cost is important when choosing a payroll system, you also want the software to perform the tasks you need.

What kind of payroll features does your business need? Consider the following features when choosing a payroll system:

Payment type

Do you pay your employees via direct deposit or paychecks? You want your payroll system to accommodate how you pay your employees.

If you pay your employees via direct deposit, look for a payroll system that offers free direct deposit.

If you give your employees paychecks, check that the software supports it so you can print paychecks when running payroll.

Pay period

How often do you pay your employees? Weekly, biweekly, semimonthly, or monthly? Choose a payroll system that supports your pay frequency.

If you pay your employees every week, you probably don’t want a payroll system that charges per payroll run. Again, look for a payroll system that lets you run unlimited payrolls to avoid extra charges.

Taxes

Depositing and filing taxes can be time-consuming and confusing. To avoid payroll tax headaches, choose a full-service plan that deposits and files taxes for you when you run payroll.

If your payroll software deposits taxes for you, you do not need to stress about mistakes or late payments. Your payroll software has you covered. Look for a system with a tax filing accuracy guarantee, like Patriot Software.

Bonuses, commissions, and tips

If your employees earn bonuses, commissions, or tips, you need a payroll provider that handles these money types.

For example, you own a restaurant. Your employees receive tips and report their earnings to you. You need a payroll provider that makes paying tipped employees—and handling payroll taxes on tips—a breeze.

Time and attendance

Time and attendance lets you track the hours your employees work. Have your employees enter their hours online, or enter them yourself. Look for payroll systems that have a time and attendance software integration.

Your employees enter their hours, you review and approve them, and voila! You can seamlessly send the hours to payroll.

Robust reports

One of the beautiful things about payroll software is that all of your payroll-related information is in one easy to access location. It also generates payroll reports so you can filter the data you need, like how much you paid employees and your payroll tax liabilities.

Check out what kind of payroll reports potential software systems offer. Also find out how easy the reports are to generate and comprehend.

3. Support

When you use a payroll system, you have control over your payroll. But you shouldn’t be left alone if you have questions. Part of knowing how to choose a payroll service is looking for a provider with support.

Some providers charge extra for support, while others may include it in your software price.

Is support important to you? Look at customer reviews and ratings to learn what you can expect from the payroll provider. After all, if you need help, you want it immediately—not after spending over an hour on the phone listening to hold music.

| Questions to Ask About Support |

|---|

| 1. Will customer support help me set up my payroll? 2. Does the company outsource its customer support? 3. Is customer support included in my payroll software price? 4. How can I contact support? (e.g., phone, email, and/or chat) 5. Do other customers talk positively or negatively about their support? |

4. Learning curve

You’re an expert in your business. Payroll? Probably not so much.

Some payroll systems can get tricky and require background knowledge to run them. You want payroll software to make your life easier, not harder.

Be confident that you can learn how to use the software before you buy it. Purchasing a payroll system with a minimal learning curve saves you time and money. You don’t want to buy something that takes time to learn, sits without use, or causes you to spend money on resources to learn how to use it.

Look for intuitive and easy-to-use payroll software. Some payroll systems are more recognized for their usability than others. For example, Patriot Software is repeatedly recognized for its ease of use by customers and industry experts.

5. Free trial

If possible, try out the payroll system before you buy it. Some providers offer a self-guided demo or free trial so you know what you’re getting into.

Check to see if the payroll system you are considering offers a free trial. It lets you learn the system with a hands-on approach and temporarily run your payroll at no cost to you.

6. Contract

When it comes to knowing how to choose a payroll service, don’t overlook your commitment level.

Business owners enter into contracts all the time. You need a contract for leases, loans, partnership agreements, confidentiality agreements… you name it, there’s a contract. Payroll systems do not have to be one of those things.

You might prefer a payroll system that uses month-to-month pricing without a contract. That way, you can pause or leave if your needs change. You can get out at any time with no fees if you do not have a payroll software contract.

Ready to shop around for software?

A good rule of thumb when shopping for software is to select the best value for your money. The service also should include any payroll features your business needs. You can also benefit from a low learning curve, helpful support, a free trial, and month-to-month pricing.

Choosing a payroll system doesn’t have to be difficult. Here are some tips to help you choose the best software for your business:

- Read customer reviews on review sites, like Trustpilot

- Do a cost analysis, making sure to factor in all hidden costs

- Call the software company with any questions you have (and get a feel for the kind of support you can expect)

- Sign up for a no-obligation demo to see how the software works

Looking for affordable software with unlimited payrolls, free USA-based support, month-to-month pricing, and all the features you need to quickly and easily run payroll? Patriot’s online payroll checks all the boxes, plus we offer a self-guided demo and free trial to get you started. But don’t take our word for it—check out some of our customer reviews to see why businesses across the U.S. trust Patriot Software!

This is not intended as legal advice; for more information, please click here.