Small business owners have certainly been through the ringer in 2020. The Paycheck Protection Program (PPP) was a lifeline many business owners were willing to grab, but there were some strings attached. Complicated rules and unanswered questions left many people scrambling.

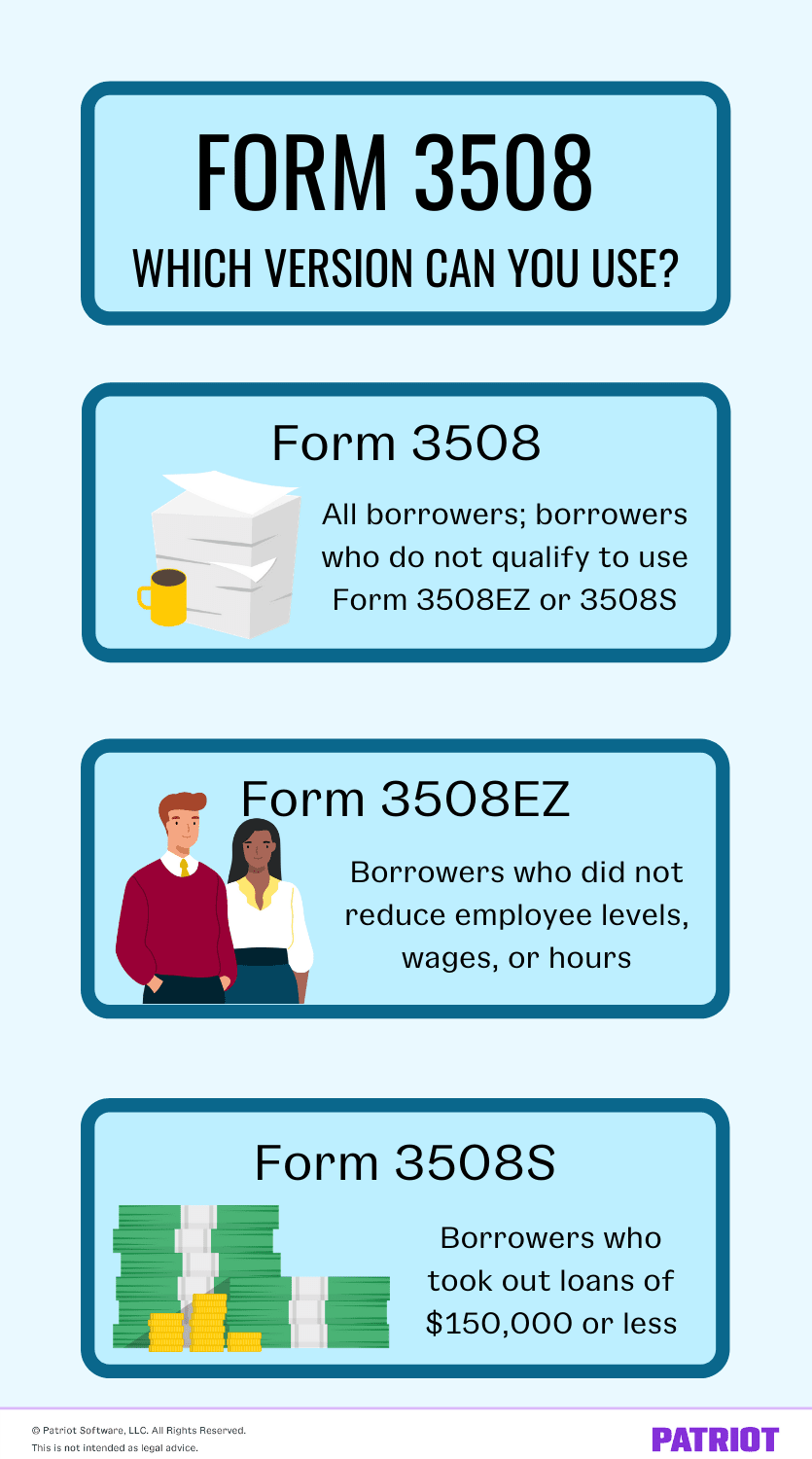

But now, you’re in the home stretch. You’ve gotten the loan and just need to apply for forgiveness using Form 3508. However, there are three versions of Form 3508 out there.

Which Form 3508 is the one that you need?

What is Form 3508?

The PPP provided forgivable loans to businesses impacted by COVID-19. After receiving a PPP loan, borrowers must apply for forgiveness through their lender by filling out the Small Business Administration (SBA) form and providing supporting documents. SBA Form 3508 is the document PPP loan borrowers must complete to request loan forgiveness. The three versions of the form include a regular Form 3508, Form 3508EZ, and 3508S.

The SBA and Treasury released Form 3508 on May 15, 2020. Many business owners and financial advisors shared concerns about its complexity and rigid rules.

In response, Congress passed the PPP Flexibility Act of 2020 to make changes to the PPP, prompting the release of a revised Form 3508 on June 16. To make things even easier for eligible borrowers, the SBA and Treasury also released Form 3508EZ.

But for months, there were still concerns about the forms. So on October 8, the SBA and Treasury released Form 3508S for qualifying borrowers.

Although the three versions of Form 3508 are different, they all begin by asking for the following business and PPP loan information:

- Business legal name

- Business address

- DBA or trade name (if applicable)

- Taxpayer identification number (e.g., EIN)

- Phone number

- Primary contact

- Email address

- SBA PPP loan number

- Lender PPP loan number

- PPP loan amount

- Disbursement date (when you received the loan)

- Number of employees at time of loan application

- Number of employees at time of forgiveness application

- Economic Injury Disaster Loan (EIDL) advance amount

- EIDL application number

- Forgiveness amount

Rundown on PPP forgiveness eligibility

For full PPP forgiveness, you must meet a few requirements. Borrowers must use Forms 3508 to not just request loan forgiveness, but also to determine the amount of forgiveness.

To get your PPP loan forgiven, you must:

- Use it for eligible expenses (60% of the loan for payroll costs and 40% for mortgage interest, rent, and utility costs)

- Keep your employee full-time equivalent (FTE) levels up

- Not reduce employee wages by more than 25%

So … which Form 3508 do you need for PPP forgiveness?

Form 3508 vs. 3508EZ vs. 3508S: What’s the difference?

Form 3508EZ and S are simplified documents for eligible employers and solopreneurs. Unless you qualify to use the EZ or S versions, you must apply with the regular Form 3508.

The difference between the forms lies in the calculations you need to do. Form 3508 requires the most calculations, Form 3508EZ requires less calculations, and Form 3508S is nearly calculation-free (cue the celebration).

The form you use depends on certain factors such as:

- How much you borrowed

- Whether you reduced employee salaries and headcount

Take a look at details about each form as well as their eligibility requirements to determine how you can apply for PPP loan forgiveness.

Who can use Form 3508?

Any borrower who received a Paycheck Protection Program loan can use Form 3508 to apply for forgiveness.

But because it is the most complex form, you should only use this form if you do not qualify to use Form 3508EZ or 3508S.

Form 3508 is five pages long and broken down into the following parts:

- Calculation form

- Signature/authorization form

- Schedule A

- Schedule A worksheet

- Demographic information form (optional)

Why so long? Form 3508 requires significantly more calculations than the other forms because it has an additional calculation for borrowers who reduced their employee numbers and/or salaries. And like Form 3508EZ, the regular 3508 requires borrowers to calculate their payroll and nonpayroll costs using the 60% / 40% rule.

Borrowers who reduce their full-time equivalent employees, employee salaries, or both also reduce their PPP forgiveness amount. This form has a calculation for determining how much you reduce your loan forgiveness amount by for these adjustments.

Who can use Form 3508EZ?

Qualifying borrowers can use Form 3508EZ, the simplified version of Form 3508, to apply for PPP forgiveness.

You can use this form if you meet one of the following requirements:

- Are self-employed and have no employees

- Have employees but did not reduce their wages by more than 25%, did not reduce employee numbers, and did not cut employee hours OR have employees but did not reduce wages by more than 25% and could not operate as normal as a result of reduced business activity due to COVID-19 health guidance compliance

Like Form 3508, the EZ version requires borrowers to calculate payroll and nonpayroll costs. But because of the eligibility requirements to use the form, you do not need to make adjustments for FTE and salary reductions.

Form 3508EZ is three pages long and broken down into the following parts:

- Calculation form

- Signature/authorization form

- Demographic information form (optional)

Who can use Form 3508S?

Form 3508S is the simplest PPP loan application form available. Only borrowers who took out loans that were $150,000 or less can use the form.

The Consolidated Appropriations Act expanded who can use this version of Form 3508. Originally, only borrowers who took out loans of $50,000 or less could use it. Now, borrowers who took out loans of $150,000 or less can use it.

Affiliate businesses (e.g., businesses with common management, stock ownership, and identity of interest) that took out a combined total of PPP loans of $2 million or more cannot use Form 3508S.

Form 3508S requires fewer calculations and less documentation than Forms 3508 and 3508EZ. If you took out a loan of $50,000 or less, your forgiveness amount won’t be reduced if you decreased your FTE employee levels or wages.

This form is two pages long and broken down into the following parts:

- Signature/authorization form

- Demographic information form (optional)

Which Form 3508 version should you use?

Skimmers, rejoice.

Here’s the bottom line on which form you should use:

- 3508: Borrowers who do not qualify to use Form 3508EZ or 3508S

- 3508EZ: Borrowers who are self-employed with no employees OR borrowers who did not reduce employee salaries by more than 25% and did not reduce employee hours OR borrowers who reduced business activity due to COVID-19 health guidelines and did not reduce employee salaries by more than 25%

- 3508S: Borrowers who took out loans of $150,000 or less

Keep in mind that, regardless of which version of Form 3508 you use, you must have supporting documentation to justify your loan forgiveness request.

Worried about gathering all your documents to fill out Form 3508? Don’t be. With Patriot’s online payroll, you have access to all the payroll reports you want to grab the data you need. Not a customer? Get a free trial of our software to streamline the way you get payroll information for the future!

This is not intended as legal advice; for more information, please click here.