Running your business? You’re a pro. Understanding Form W-2? Probably not so much. But when you have employees, you’re responsible for withholding taxes from their employees’ wages and reporting the amount to the government. Not to mention, employees need Form W-2 to file their individual tax returns.

Ready to get a firm grasp on this whole Form W-2 thing? Read on to learn and understand Form W-2.

Understanding Form W-2

As an employer, you’re responsible for accurately filling out and sending Forms W-2 to your employees and the Social Security Administration (SSA).

But before you can do that, you need to thoroughly know and understand Form W-2. Check out all the must-have information for understanding W-2 forms below.

What is Form W-2?

IRS Form W-2, Wage and Tax Statement, reports information about your employees’ annual wages and lists what you paid them during the year. You must send copies of Form W-2 to each employee and the SSA.

Form W-2 includes information about an employee’s gross wages and withheld taxes, as well as other information, like tip income and deferred compensation.

Send W-2 forms to any employees you paid a salary, hourly wages, or another form of compensation during the year.

Only employees receive Form W-2. Do not give your independent contractors W-2 forms. To determine whether your worker is an employee vs. independent contractor, check with the IRS and read up on classification rules.

In addition to sending Form W-2, you must send Form W-3, Transmittal of Wage and Tax Statements, to the SSA. Form W-3 is simply a summary of your Forms W-2. Don’t forget to sign Form W-3 before you send it to the SSA.

Information on Form W-2

To fill out Form W-2, you need up-to-date employee and payroll records, including a current Form W-4 for each employee.

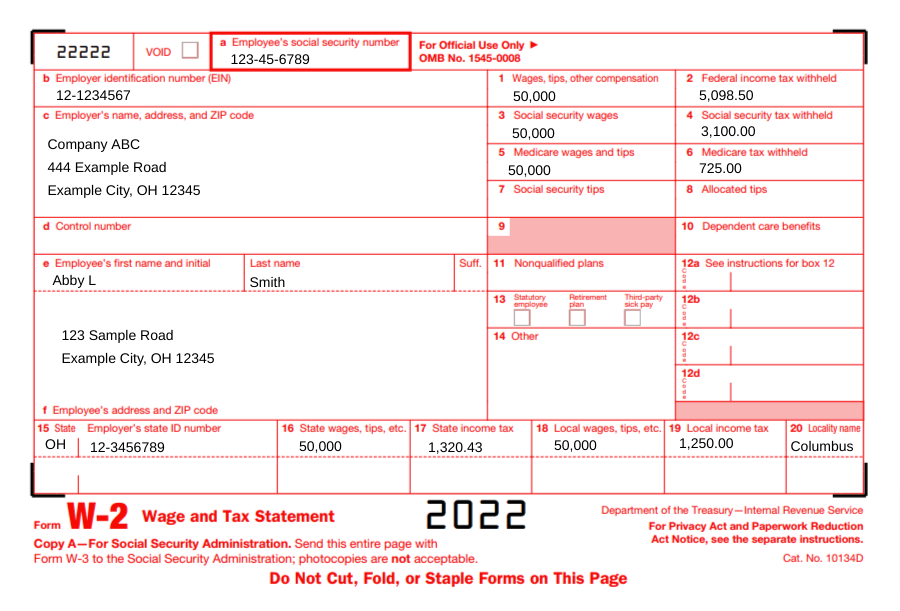

Form W-2 consists of multiple boxes labeled with either a number or a letter. Check out a breakdown of what information you must include in each box below:

- a: Employee’s Social Security number

- b: Employer Identification Number (EIN)

- c: Employer’s name, address, and ZIP code

- d: Control number

- e: Employee’s first name, initial, last name, and suffix

- f: Employee’s address and ZIP code

Now let’s take a look at the numbered lines you must fill out:

- 1: Wages, tips, and other compensation

- 2: Federal income tax withheld

- 3: Social Security wages

- 4: Social Security tax withheld

- 5: Medicare wages and tips

- 6: Medicare tax withheld

- 7: Social Security tips

- 8: Allocated tips

- 9: N/A (Blank)

- 10: Dependent care benefits

- 11: Nonqualified plans

- 12a – 12d: Codes

- 13: Checkboxes for statutory employee, retirement plan, and third-party sick pay

- 14: Other

- 15: Employer’s state ID number

- 16: State wages, tips, etc.

- 17: State income tax

- 18: Local wages, tips, etc.

- 19: Local income tax

- 20: Locality name

Each business’s Form W-2 is different. You likely won’t need to fill out every single W-2 box.

Example of Form W-2

As you can tell, there’s a lot of information you need to include on Form W-2. Take a look at an example of Form W-2 filled out below to get an idea of what yours might look like.

Copies of Form W-2

There are several copies of Form W-2 you must send out. Check out a list of copies and their recipients below:

- Copy A: SSA (along with Form W-3)

- Copy B: Employee (to file with their federal tax return)

- Copy C: Employee (for their records)

- Copy D: Keep for your records

- Copy 1: State, city, or local tax department, if applicable

- Copy 2: Employee (to file with their state, city, or local income tax return)

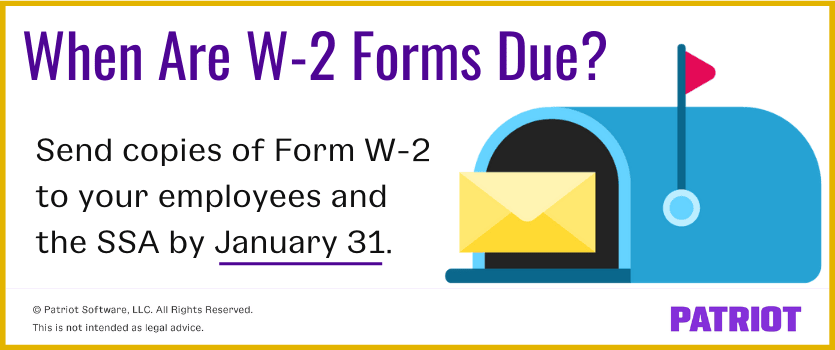

Form W-2 deadline

Send Form W-2 to your employees by January 31 each year. Send Form W-2 to any employees you paid during the year, including ones who no longer work for you.

You must also send Form W-2 and W-3 to the SSA by January 31. You can send the forms to the SSA via mail. Or, you can opt to e-file Forms W-2 and W-3 online.

Remember, you are responsible for distributing multiple copies to various parties. Don’t forget to send each copy to the correct party by the deadline.

Form W-2 options

When it comes to creating copies of Form W-2 for your employees and the SSA, you have a couple of options. You can:

- Print and distribute Form W-2 yourself

- Use payroll software to fill out forms

Print and distribute Form W-2 yourself: If you print the forms yourself, print Form W-2 on official copies. You can purchase legitimate forms from the IRS or a local office supplies store. You can view a sample of Form W-2 on the IRS website. However, you cannot use the sample.

When printing Forms W-2, be sure that the name, address, and SSN is accurate for each employee. Also, double-check that your business’s information is correct. You can only print on W-2 forms. Do not handwrite on Form W-2.

Use payroll software to fill out forms: If you opt to use a payroll service or software, chances are they’ll do most of the legwork for you. Many online payroll software companies will fill out Forms W-2 for you based on the information you input into the system. And, some payroll services even send Forms W-2 directly to the SSA on your behalf.

If your provider doesn’t handle the distributing and filing for you, look into what options you have. Check with your payroll provider to see whether or not you can print Forms W-2 directly from your account and if electronic W-2s are an option for your employees.

Even if you use a payroll service or software that fills in the Forms W-2 for you, it’s still a good idea to double-check Forms W-2 for any errors before distributing them.

If an accountant handles your business and payroll taxes, check with them to see if they also file Form W-2 for you.

Don’t want to deal with the hassle of Form W-2? Let Patriot take care of your Form W-2 filing for you. Patriot’s Full Service payroll will generate and file Form W-2 on your behalf. Your only responsibility? Giving Forms W-2 to your employees. Try it out with a free trial today!

This article is updated from its original publication date of January 19, 2012.

This is not intended as legal advice; for more information, please click here.