When it comes to running your business, you may need to obtain a business license and permit to operate. But, what are the steps to obtain a business license? Welcome to your rundown on how to get a business license.

What is a business license?

A business license permits you to operate your company within your industry or jurisdiction. Your business may need to get several licenses before providing goods and services. Some licenses may be required by the federal government, while others may be required by your state or county.

So, what do you need a business license for? Most businesses need to apply for a general business license to operate. You may be able to apply for a general license when you form your business structure and register with the state. Depending on your state or locality’s requirements, you may also need to apply for a business license with your locality.

Depending on what your business does and where you’re located, you may need to get other licenses, such as professional licenses, DBA (doing business as) license, or other industry-specific licenses.

Before you begin the business license application process, check to see which licenses you need to obtain for your company. For more details on other licenses, check out the Small Business Administration’s website.

Cost of a business license

So, how much does a business license cost? The cost of a business license depends on a number of factors, including:

- License type

- Business location

- Additional fees

A business license can cost anywhere from tens of dollars to hundreds of dollars. Not to mention, you may need to pay additional fees for processing or annual renewals.

Like with anything in business, do research to find out the costs associated with obtaining a business license before diving into applications. That way, you know how much to allocate for your business license application(s) and can build any recurring fees into your budget.

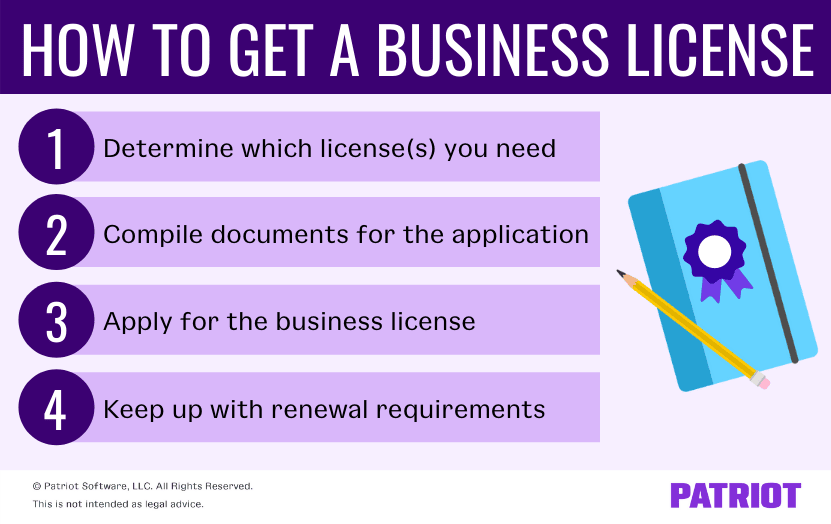

How to get a business license: 4 Steps

How do you get a business license? Getting a business license can vary depending on your state, company, and which license you’re applying for. However, there are some general steps you need to take to obtain a business license.

Before you begin applying for licenses, make sure you form your business entity (e.g., corporation, sole proprietorship, S Corp, etc.) and apply for an employer identification number (EIN). That way, you can get your general business license and have everything you need to begin applying for additional licenses.

After you choose your business structure and apply for an EIN, you can follow these four steps to apply for a business license. Again, keep in mind that steps may vary depending on which license you’re applying for.

1. Determine which license(s) you need

Start off by researching which business licenses your company will need to operate, including ones at the federal, state, and local levels. The type of business licenses can vary depending on the type of business you’re running.

You can find out which licenses and permits you need by:

- Contacting your state’s Secretary of State office, Department of Revenue, or similar agency

- Looking at available resources through your local SBA office

- Working with a business lawyer or another professional

Whatever you do, don’t go into applying blindly. The last thing you want to do is apply for business licenses you don’t need or fail to obtain the licenses you do need.

2. Compile documents for the application

When you apply for a license, you typically need to provide a variety of documents and information to fill out your application.

Once you narrow down which licenses you need, take a look at each application to determine which documents you must gather.

Many applications ask for:

- A description of the business and its planned activities

- EIN

- Business location

- Copies of business records (e.g., articles of incorporation)

- Proof of state or local tax status (e.g., sales tax permit)

- Lists of owners and managers

Many applications may also require a filing fee to submit your application. Before applying, make sure you have all of your documents in order and payment for a filing fee handy (if applicable).

3. Apply for the license

After you get your application and documents ready to go, you can apply for your license (woohoo!).

Keep in mind that each application is different, so follow the instructions to a T and take your time. Depending on the application, you may be able to submit the application online. Some applications may require you to mail in or fax the paperwork or fill out the application in person.

Once you apply for the license, you need to wait for approval. In some cases, you may need to provide additional documents after submitting the application.

4. Keep up with license renewal requirements

After you’re approved and receive your business license, your job doesn’t stop there. Depending on the license, you may need to renew the license on a regular basis (e.g., every two years).

Read the fine print and make note of which licenses you need to renew and how frequently you must renew them. Mark your calendar or set a reminder to avoid accidentally letting your license expire. If your license expires, you’ll have to renew it according to the regulations.

How long does it take to get a business license?

The length of time it takes to get a business license can vary depending on which license you’re applying for and your location. For many licenses, it can take anywhere from a few days to a few weeks.

To help expedite the application process and potentially receive your business license sooner, consider applying online, if possible. Online applications are quicker (and generally easier) than mailing a paper application or filling one out in person.

Another way to ensure your license is in your hands sooner is to follow all directions and submit all necessary paperwork right off the bat. If you forget to follow a step in the application process, make an error, or forget to include a document, it can prolong the process.

Finally, don’t put off applying for your business license. Apply as soon as you possibly can so you can have your license as soon as possible.

Business license requirements by state: Chart

Ready to apply for a business license? To get the ball rolling, check out your state’s business licensing requirements and steps to apply below.

This is not intended as legal advice; for more information, please click here.