Target’s slashing prices on inventory like appliances and televisions. Marriott’s hotel room demand for leisure travel is up 10% compared to 2019 bookings. What does this mean for consumer spending in 2022? It means that a great shift in consumer spending 2022—from goods to services—might be here.

For product-based businesses, this change could lead to a drop in cash flow, throw off your projections, and leave you with a product surplus. In short, consumer spending trends can be worrying if you’re a business owner. But, you don’t have to be a sitting duck. Read on for ways you can respond.

Consumer spending 2022: What’s going on?

Recent reports indicate there’s a shakeup in the consumer spending forecast for 2022. Rather than spending mostly on products like home goods, consumer spending is beginning to focus on services.

As social distancing decreases, demand for services like dining out, staying in a hotel, flying, and attending concerts increases.

Although this drop in product demand and spike in service demand seems out of whack, it’s really more of a balance to the way things were before the pandemic. According to the Washington Post:

Now, consumers are returning to their previous habits with the balance between goods and services spending back to where it stood in May 2020…”

News reports of retailers like Target and Walmart having too much inventory might be alarming if you’re a product-based retailer. But, this shift in consumer spending trends 2022 could also help:

- Service-based businesses that have struggled throughout the pandemic

- Supply chain issues (which 56% of businesses currently face)

- Rising inflation (31% of small business owners say inflation is their biggest risk)

But if you’re a product-based business dealing with the immediate impact of consumer spend in the U.S., you may be wondering what you can do.

How your product-based business can respond

As U.S. consumer spending targets activity-related purchases and scales back on certain product purchases, you may decide to take action.

Your product-based business might consider taking targeted action such as:

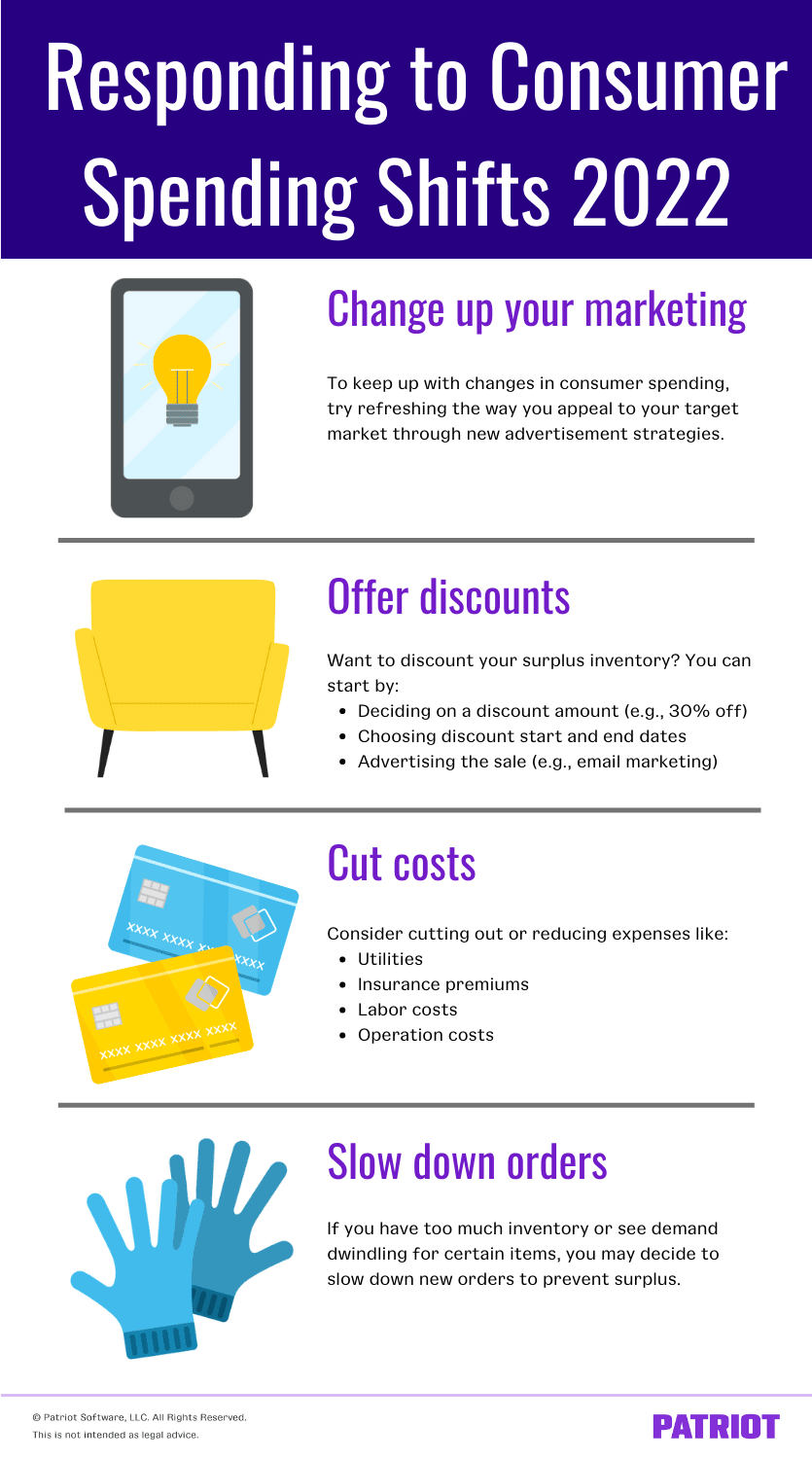

1. Change up your marketing

Not all products are getting the cold shoulder. Some goods, like beauty items, household essentials, and back-to-school supplies are still getting love from customers. And, demand for products consumers can use for traveling (e.g., sunscreen, fashion, etc.) is up. To capitalize on this type of product demand, you may need to change up your marketing.

Look at your inventory. Do you have products that customers can use for activity-related events (e.g., traveling)? If so, get creative. Maybe what you need to do to keep up with consumer spending 2022 is refresh the way you appeal to your target market.

Change up your marketing to appeal to customers shopping for products they can use while enjoying activities. For example, choose photographs for your website that show customers traveling, eating out, or attending a concert while wearing or using your products.

Bonus: Don’t think marketing is the issue? You might consider releasing a new product to keep up with increased service-related demand. Think back to the era of businesses producing masks at lightning speed to keep up with consumer demand.

2. Offer discounts

Have surplus inventory? Need to get rid of some of it? Whether your inventory is going bad or you need a cash flow boost, you may decide to discount pricing on your surplus. Doing so can help you turn a profit on low-demand items while also making room for new stock.

To offer discounts, you must:

- Decide on a discount amount you can still profit from (e.g., 30% off)

- Choose discount start and end dates

- Advertise the sale (e.g., email marketing)

Offering discounts may hurt your revenue forecasts and, depending on how much you mark down items, result in a loss. But, discounting your surplus inventory can pave the way for you to get rid of unwanted products and pave the way for new stock.

3. Cut costs

Another way you can respond to recent consumer spending data is to cut business costs. Cut out or reduce expenses to give your business a cushion in periods of low demand.

Analyze your records and determine the expenses you can cut out entirely. For other expenses, like accounting software, you may be able to find a more cost-effective solution elsewhere.

Consider reducing:

- Utilities (e.g., downgrade internet plan)

- Insurance premiums (e.g., cut out coverage you don’t need)

- Labor costs (e.g., don’t let employees work overtime)

- Operation costs (e.g., try buying wholesale for small business)

Talk with your vendors to see if there is any wiggle room on pricing, to see if you can use less expensive materials, etc.

4. Slow down orders

Many businesses adapted to supply chain issues by over-ordering or ordering stock far ahead of time. But now, these types of adaptations might be causing a pileup of inventory.

If you have too much inventory or see demand begin dwindling for certain items, you may want to slow down new orders. Pay attention to inventory levels. Weigh the pros and cons of waiting to order until your inventory is lower.

With the shift in consumer spending habits 2022, you may find that new inventory delays are better for your business than overstocking.

This is not intended as legal advice; for more information, please click here.