Business owners have a lot of decisions to make, especially in the beginning. One of the most important decisions is how to handle bookkeeping for your business. There are three methods of accounting to choose from: Cash-basis, modified cash-basis, and accrual accounting.

The two methods that differ the most are accrual and cash-basis accounting. Modified cash-basis accounting is a hybrid of the two. To help determine the method that best fits your business’s needs, compare accrual vs. cash-basis accounting. And, review accounting laws to ensure you stay compliant.

Accrual vs. cash-basis accounting

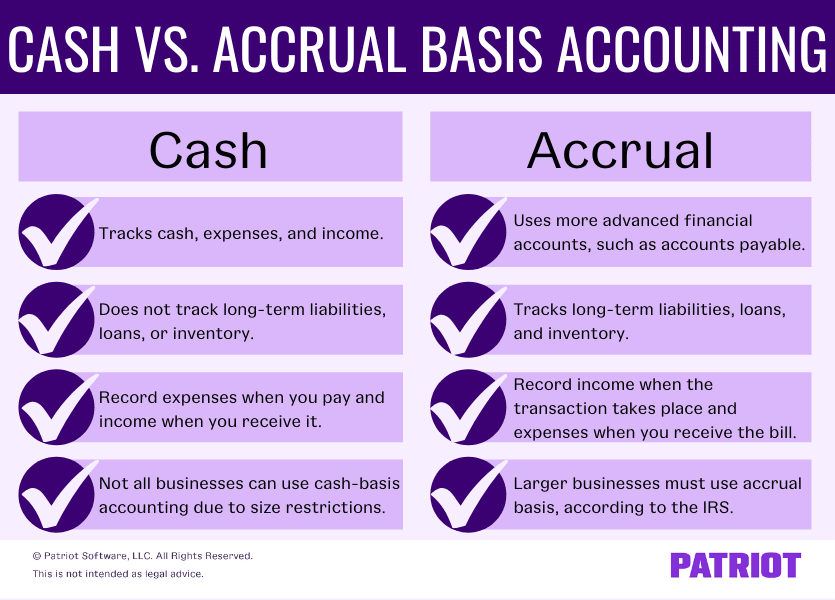

To pick the best accounting method for your business, you must understand the differences between cash basis and accrual basis. Compare and contrast cash basis vs. accrual basis below.

Cash-basis accounting

Of all three accounting methods, cash-basis accounting is the easiest. Because of its ease of use, many small businesses prefer this method for their bookkeeping.

Accounting

Cash-basis accounting only lets you use cash accounts to track and record transactions. You can record things like cash, expenses, and income with the cash-basis method. But, you cannot track long-term liabilities, loans, or inventory.

Businesses using cash basis record income when they receive it. And, you record expenses when you pay them. Do not record income or expenses at the time you send or receive a bill with cash-basis accounting.

Pros and cons

Advantages of cash-basis accounting include:

- Simple and easy to use

- Ideal for small businesses

- Cheaper than other methods

- Less information to track

- Easier to maintain

There are some cons to cash basis, too, including:

- Restrictions on which businesses can use it

- Businesses typically can’t use this method as the company grows

- Fewer available accounts (e.g., can’t track long-term financial items)

Balance sheet

The cash basis balance sheet includes three parts: assets, liabilities, and equity. The balance sheet does not track or record accounts payable, accounts receivable, or inventory with this method. So, your balance sheet does not include any unpaid invoices or expenses.

Accounts on the cash basis balance sheet include:

- Cash

- Equity

- Income

- Cost of goods sold (COGS)

Accrual accounting

Accrual accounting is the most complex accounting method available. And, it is the only method accepted by GAAP (generally accepted accounting principles). Generally, you must have some accounting knowledge to use accrual-based accounting.

Accounting

A big difference between cash basis and accrual basis is that accrual accounting uses more advanced financial accounts. These accounts include accounts payable, current assets, long-term liabilities, and inventory.

The other difference between cash and accrual is when you record transactions. With accrual basis, record income when your transaction takes place, with or without the transfer of money. And, record expenses when you receive the bill.

Pros and cons

There are a few advantages to using accrual accounting, including:

- Anticipating future income and expenses

- Projecting and viewing long-term profitability

- Helping you make smart financial plans

- Accessing many types of accounts for transactions

But, there are also some cons to using accrual accounting, including:

- Being more complex than other accounting methods

- Needing more accounting knowledge to use it

Balance sheet

The balance sheet for accrual accounting includes more details and additional accounts. Accounts on the accrual basis balance sheet include:

- Cash

- Equity

- Income

- Cost of goods sold

- Expense

- Accounts receivable

- Fixed assets

- Current assets

- Accounts payable

- Long-term liabilities

- Current liabilities

Comparing cash basis vs. accrual basis

Again, accrual basis is more complex than cash basis. And, accrual basis uses more accounts than cash-basis accounting. Take a look at how cash basis compares to accrual basis:

Modified cash-basis accounting

Now that we’ve explained the difference between cash and accrual accounting, let’s go over the third accounting method: modified cash-basis accounting. Also known as hybrid accounting, this method blends parts of cash and accrual accounting together. Businesses that need to record and balance both short- and long-term transactions find this method ideal.

Modified cash basis uses accounts from both cash and accrual basis, including:

- Cash

- Current assets

- Accounts payable

- Long-term liabilities

The method allows you to record short-term items like cash-basis accounting. But, you can also include long-term items (e.g., business loans) like you can with accrual accounting.

Accounting method laws

Again, there are restrictions on which businesses can use cash-basis accounting. And, fewer businesses can use cash basis as the company grows. But, why is that?

The IRS restricts which businesses can use cash-basis accounting to record their transactions. Larger businesses cannot use cash basis. You cannot use cash basis if you meet any of the following conditions:

- Are a corporation (but not an S Corp) with average annual gross receipts for the three preceding tax years exceeding $25 million

- Are a partnership with a corporation (not an S Corp) as a partner with average annual gross receipts for the three preceding tax years exceeding $25 million

- Operate as a tax shelter

If your business currently uses cash-basis accounting and meets or exceeds the IRS restrictions, you must switch accounting methods. Use IRS Form 3115, Application for Change in Accounting Method, to make the change.

Examples of cash accounting vs. accrual

Take a look at a few examples of recording income and expenses using the different accounting methods. Before checking your answers, test your knowledge on accrual and cash-basis accounting.

Recording expenses

1. Julia orders some supplies for her business. She uses the cash-basis method. When does she record the expense in her accounting books?

- When the supplies are delivered

- Before the supplies are delivered

- When she pays for the supplies

2. Say Julia is using the accrual accounting method instead of cash-basis. When would she record the supplies?

- Before the supplies are delivered

- When the supplies are delivered

- When she pays for the supplies

Answers: 1. C and 2. B

Recording income

1. John owns a marketing agency. He completed a project for a customer and is ready to be paid. At what point does he record his income with cash-basis accounting?

- When the client pays the invoice

- As soon as he completes the project and sends the invoice

- Right after he finishes the project, but before invoicing the client

2. John finishes a project for another client. Let’s say he’s using the accrual method. When will John record his income with the accrual accounting method?

- When the client pays the invoice

- Right after he finishes the project, but before invoicing the client

- As soon as he completes the project and sends the invoice

Answers: 1. A and 2. C

Here is a quick cheat sheet to use for recording transactions:

| Cash Basis | Modified Cash Basis | Accrual Basis | |

|---|---|---|---|

| Available Accounts | Cash Accounts Only | Cash & Accrual Accounts | Cash & Accrual Accounts |

| Record Income | When Paid | When Paid | When Invoiced |

| Record Expenses | When Paid | When Paid | When Billed |

How do you change from cash basis to accrual?

As mentioned, growing businesses may need to change their accounting method and file Form 3115. But before submitting Form 3115, you must make a few changes to your books.

Complete the following steps to adjust your books and reflect the shift in accounting methods:

- Add prepaid and accrued expenses

- Add accounts receivable

- Subtract cash payments, customer prepayments, and cash receipts

After you make the necessary changes to your books, file Form 3115. The earlier you file the form, the better. Attach your profit and loss statement, balance sheets, and any adjustments from the previous year to the form when you submit it.

How to choose an accounting method

Your business needs are unique, so it’s important to pick the accounting method that fits your company. Before making your decision, consider a few factors.

Think about things like:

- Accounting laws you must follow

- How big your business is

- How much your business will grow over time

- Future accounting needs

- Types of transactions you need to record

- Which types of accounts you need (e.g., long-term liabilities)

This article has been updated from its original publication date of July 29, 2013.

This is not intended as legal advice; for more information, please click here.