You work long hours as a small business owner. And if you have children or dependents, you might need help providing care while you work. But with 58% of families expecting child and dependent care expenses to cost more than $10,000 per year, things can add up quickly. Did you know the IRS offers some relief for the high cost of childcare? If you didn’t, the child and dependent care credit may soon become your new best friend.

What is the child and dependent care credit?

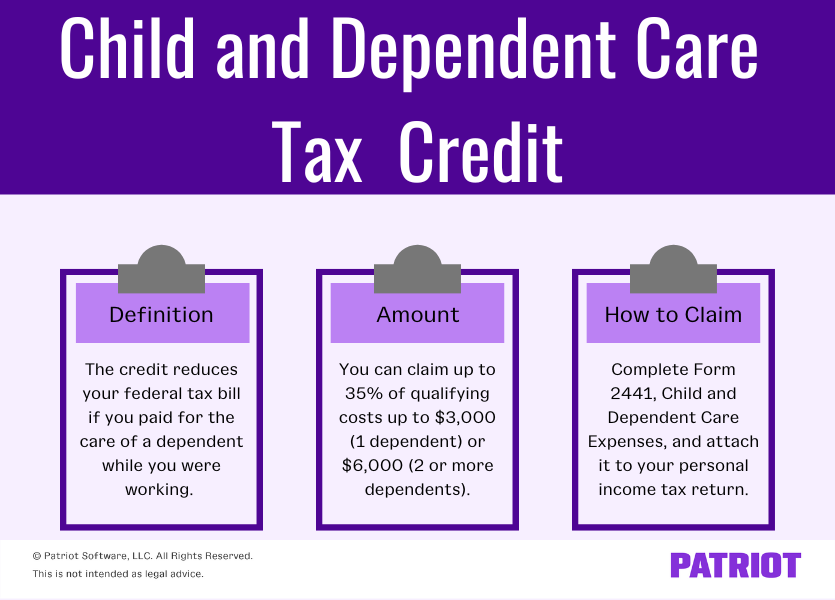

The child and dependent care credit reduces your federal tax bill if you pay for the care of a dependent while you worked or actively looked for work. For example, you may be eligible to claim the credit if you pay for care from:

- Daycares

- Babysitters

- After-school programs

- Day camps

The credit is worth a percentage of qualifying expenses, up to a certain amount set by the IRS (which we’ll get to later). Read on to learn who can claim the credit, how much it’s worth, and how to claim it.

Can I claim the tax credit?

There are several qualifications (that the IRS sets) to consider before you claim the child and dependent care tax credit.

You can claim the tax credit if you:

- Paid childcare expenses so you (and your spouse, if filing a joint return) can work or actively look for work

- Lived in the U.S. for more than half the year

- Meet the filing status requirements*

*Your tax filing status must be single, married filing jointly, head of household, or widow/widower with a dependent child. Generally, you cannot claim the credit if your filing status is married filing separately.

When can’t I claim it?

Not all childcare counts toward the tax credit. You cannot claim the credit if you made payments to the following people for child or dependent care:

- Spouse

- Parent of the qualifying dependent if your child is under the age of 13

- Dependent

- Your child who will be under 19 years old at the end of the year

Day camp costs (e.g., soccer camp) count toward the child and dependent care credit if you work while your dependents receive care. But, you cannot claim the credit on costs for an overnight camp. You can only claim day camp expenses.

What is a qualifying dependent?

The qualifying dependent is the person who receives the care. A qualifying dependent is your dependent child. The dependent must be under 13 years old at the time of the child care.

A qualifying dependent could also be a spouse or dependent who is 13 years old or more. The spouse or dependent must be physically or mentally incapable of self-care. The individual must have lived with you for more than half of the year to meet the requirements.

How much can I claim?

The child and dependent care credit doesn’t cover all your childcare costs. You can claim a credit on a percentage of your total care expenses, up to a certain amount. So, make sure you keep records of your payments toward the care.

For 2022, you can claim up to 35% of your qualifying childcare expenses, up to a maximum of:

- $3,000 (one dependent)

- $6,000 (two or more dependents)

Once you determine the care costs you want to claim, you take a percentage of that amount. The credit is between 20% and 35% of your allowable expenses. The percentage you receive depends on your adjusted gross income.

If your AGI is below $15,000, you get the full 35%. That means that if you had $3,000 of care expenses for your child, you would receive a $1,050 credit. The largest credit you can get is $1,050.

The percentage you get drops by 1% for every extra $2,000 of income. It continues to lessen until the income reaches 20%, or $43,000. That means that if your income is $43,000, you get 20%. If you had $3,000 of care expenses for your child, you would receive $600.

The child and dependent care credit is non-refundable. The credit can take your tax bill to zero, meaning you don’t owe any taxes. But, you cannot receive the leftover amount of the credit as a refund. Let’s say you owe $700 in taxes and you get a credit of $1,000. You can use the credit to erase your tax liability. But, you do not receive a refund for the remaining amount of $300 ($1,000 -$700).

Wait … What happened to the 2021 changes to the credit?

In 2021, the government made a few changes to the child and dependent care credit via the American Rescue Plan. The bill:

- Increased the highest percentage available from 35% to 50%

- Increased the credit amount (parents could calculate the credit on expenses up to $8,000 (one dependent) or $16,000 (two or more dependents)

- Expanded credit eligibility to include all parents who spent money assuring their dependent’s well-being and protection

- Made the tax credit refundable

However, these changes only applied to tax year 2021. These changes are no longer in effect.

How do I claim the credit?

Claim the child and dependent care credit using IRS Form 2441, Child and Dependent Care Expenses. Attach the form to your personal income tax return (e.g., Form 1040).

On Form 2441, submit the care provider’s name, address, and tax identification number (TIN). If the care provider is an individual, the tax ID number is their Social Security number. You can use Form W-10, Dependent Care Provider’s Identification and Certification, to request information from the care provider.

If the care provider is tax-exempt, you don’t need a tax identification number. You just need to write “tax-exempt” on Form 2441. A tax-exempt child care provider might be a church or a school.

You cannot claim the credit on more than one tax return. The IRS applies tiebreaker rules if more than one taxpayer claims a dependent. The tiebreaker rules determine which taxpayer gets to claim the dependent.

Spending hours on bookkeeping keeps you from your family and growing your business. Finish your books in a few simple steps with Patriot’s online accounting software. Try it for free today.

This is not intended as legal advice; for more information, please click here.