Do you want your business to make a profit? Duh, of course you do! But when you’re starting out, it may take a few years before you enter profit territory. And after you start making a profit, you may be at the break-even point for a while. So, what is the break-even point?

What is a break-even point?

When your company reaches a break-even point, your total sales equal your total expenses. This means that you’re bringing in the same amount of money you need to cover all of your expenses and run your business. When you break-even, your business does not profit. But, it also does not have a loss.

Typically, the first time you reach a break-even point means a positive turn for your business. When you break-even, you’re finally making enough to cover your operating costs.

Finding your break-even point can help you determine if you need to do one or both of the following:

- Increase your prices

- Cut expenses

If your business’s revenue is below the break-even point, you have a loss. But if your revenue is above the point, you have a profit.

Use your break-even point to determine how much you need to sell to cover costs or make a profit. And, monitor your break-even point to help set budgets, control costs, and decide a pricing strategy.

Break-even point formula

To learn how to find break-even point, you must know the break-even point formula. To know how to calculate break-even point, you need the following:

- Fixed costs

- Variable costs

- Selling price of the product

So, what’s the difference between fixed vs. variable costs? Fixed costs are expenses that remain the same, regardless of how many sales you make. These are the expenses you pay to run your business, such as rent and insurance.

On the other hand, variable costs change based on your sales activity. When you sell more items, your variable costs increase. Examples of variable costs include direct materials and direct labor.

Your selling price is how much you charge for the one unit or product.

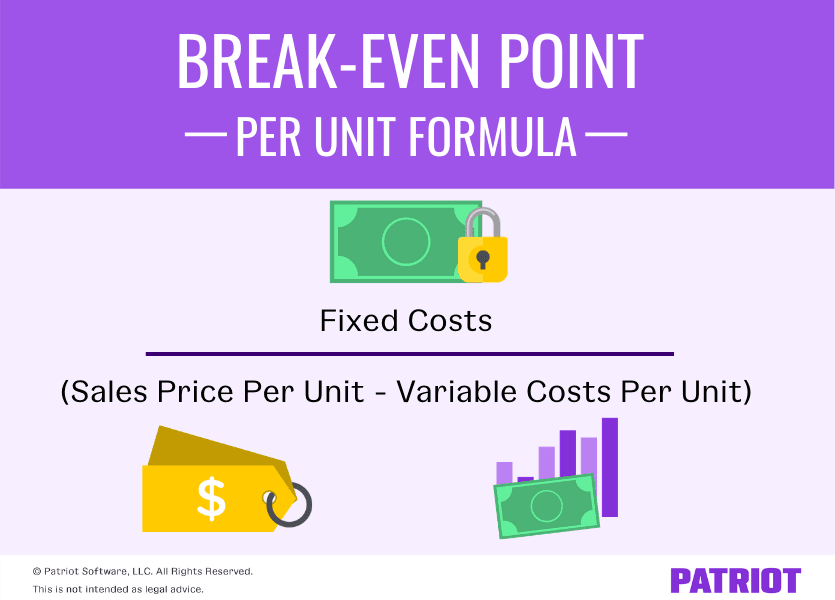

Without further ado, here’s the break-even formula:

Break-even Point Per Unit = Fixed Costs / (Sales Price Per Unit – Variable Costs Per Unit)

The sales price per unit minus variable cost per unit is also called the contribution margin. Your contribution margin shows you how much take-home profit you make from a sale.

The break-even point is your total fixed costs divided by the difference between the unit price and variable costs per unit. Keep in mind that fixed costs are the overall costs, and the sales price and variable costs are just per unit.

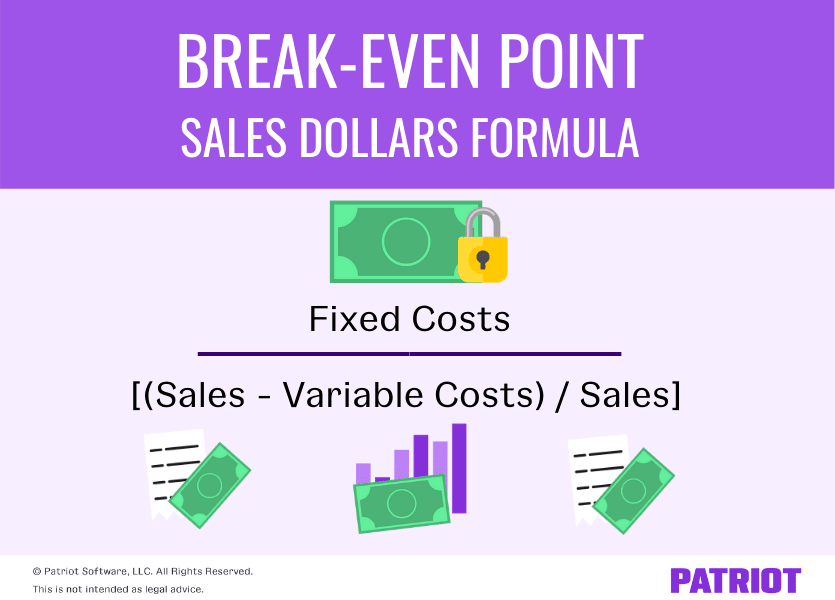

To calculate your break-even point for sales dollars, use the following formula:

Break-even Point for Sales Dollars = Fixed Costs / [(Sales – Variable Costs) / Sales]

You can use the above formulas to do a break-even analysis. A break-even analysis can help you see where you need to make adjustments with your pricing or expenses.

Break-even point examples

If you’re a visual learner, this one’s for you. To further understand the break-even point calculation, check out a few examples below.

Break-even point in units

Check out some examples of calculating your break-even point in units.

Example 1

Break-even point in units is the number of goods you need to sell to reach your break-even point. As a reminder, use the following formula to find your break-even point in units:

Fixed Costs / (Sales Price Per Unit – Variable Costs Per Unit)

Say you own a toy store and want to find your break-even point in units. Your fixed costs total is $6,000, your variable costs per unit is $25, and your sales price per unit is $50. Plug your totals into the break-even formula to find out your break-even point in units.

$6,000 / ($50 – $25) = 240 units

You need to sell 240 units to break even.

Example 2

Let’s take a look at how cutting costs can impact your break-even point. Say your variable costs decrease to $10 per unit, and your fixed costs and sales price per unit stay the same.

$6,000 / ($50 – $10)

$6,000 / $40 = 150 units

When you decrease your variable costs per unit, it takes fewer units to break even. In this case, you would need to sell 150 units (instead of 240 units) to break even.

Break-even point in sales dollars

The break-even point in dollars is the amount of income you need to bring in to reach your break-even point. Determine the break-even point in sales by finding your contribution margin ratio.

Again, here’s the break-even point for sales dollars formula:

Fixed Costs / [(Sales – Variable Costs) / Sales]

The following part of the above formula is for your contribution margin ratio: [(Sales – Variable Costs) / Sales]

To simplify things, let’s use the same amounts from the last example:

- Fixed costs: $6,000

- Variable costs per unit: $25

- Sales price per unit: $50

First, find your contribution margin. Again, this is your sales price per unit minus your variable costs per unit.

Contribution Margin = $50 – 25

Contribution Margin = $25

Next, find your contribution margin ratio. Divide your contribution margin by your sales price per unit.

Contribution Margin Ratio = $25 / $50

Contribution Margin Ratio = 50% (or 0.50)

To find your break-even point, divide your fixed costs by your contribution margin ratio.

Break-even point in sales = $6,000 / 0.50

You would need to make $12,000 in sales to hit your break-even point.

This article has been updated from its original publication date of January 3, 2017.

This is not intended as legal advice; for more information, please click here.