Do you extend credit to customers at your small business? If so, you need to record these transactions in your accounting books. Depending on the method of accounting you use, you might need to track accounts receivable. What is accounts receivable?

What is accounts receivable?

Accounts receivable is money owed to your business. You use accounts receivable to keep track of lines of credit you extend to customers.

For example, when you provide a product to a customer and invoice them to pay you later, you are extending credit. The accounts receivable account in your books shows you which lines of credit are still owed to you.

You can also refer to accounts receivable as receivables or AR. The entries in your accounts receivable account are called receivables. Receivables represent outstanding invoices at your company.

Record accounts receivable if you use the accrual method of accounting. With accrual accounting, you record income as soon as you earn it instead of when you receive money. In other words, you would record income as soon as you send an invoice, not when that invoice is paid.

Because invoices are due within a short period, accounts receivable is a short-term asset. Short-term assets can be converted into cash quickly, usually within one year.

Accounts receivable summary

Track receivables in an accounts receivable summary. Make a list of your customers and their corresponding balances due. Create columns that show how old each invoice is.

List the amounts due by date. The summary will help you see who owes you money, how much each customer owes, and who is past their due date.

Let’s say you own a mechanic shop. List the customers who owe your business money in the first column. Then, record the balances due in the appropriate aging column. Here is what your accounts receivable summary would look like.

Accounts Receivable Summary For July 1-5

| Customer | Current | Past Due 1-30 Days | Past Due 31-60 Days | past Due >60 Days | Total |

|---|---|---|---|---|---|

| Bob Jasper | $3,042 | $3,042 | |||

| Leo Blais | $1,289.50 | $1,289.50 | |||

| Amy George | $2,220.75 | $2,220.75 | |||

| Fred Astor | $375 | $375 | |||

| Heidi Baxtor | $448.25 | $448.25 | |||

| Isabelle Mann | $711.55 | $711.55 | |||

| Total | $6,552.25 | $375 | $448.25 | $711.55 | $8,087.05 |

You might have worked on Bob Jasper’s car, but he did not pay you at the same time you fixed his car. He owes you $3,042. The money he owes is a receivable. Since Bob’s payment is not past the due date, you report the amount he owes in the current column.

If Bob does not pay you within the defined period, move the amount owed over to the next aging column. This accounts receivable process allows you to keep track of how much money is owed to you.

Recording AR in your books

If you use accrual accounting, you need to record accounts receivable in your books. Record accounts receivable as an asset on the balance sheet.

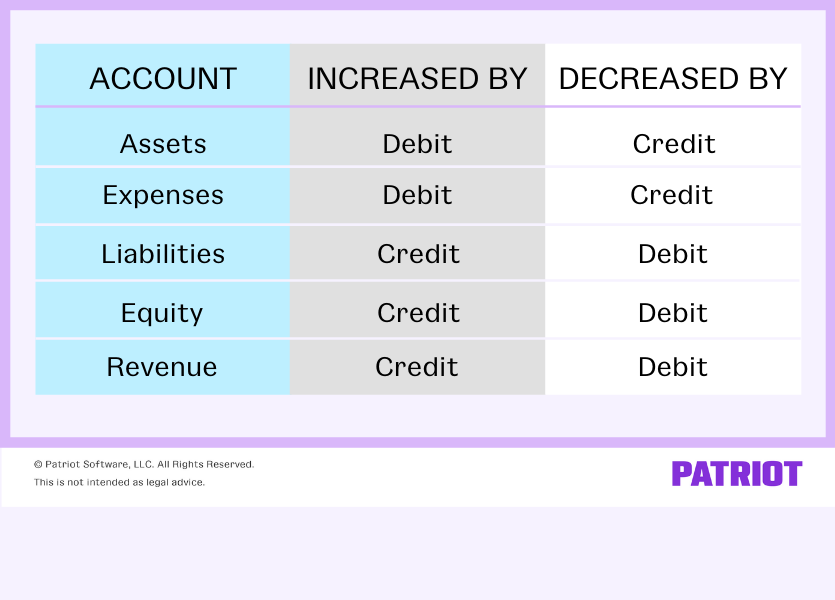

With accrual accounting, you must use double-entry bookkeeping. That means that for every transaction, you record two entries. One entry increases the account while the other decreases it. The opposing entries balance your books.

To do double-entry bookkeeping, credit one account and debit another. Each type of account is affected differently by debits and credits. Here is a guide to help you:

Accounts receivable is an asset. Assets are increased by debits. And, assets are decreased by credits.

Think of when you sell a product and invoice a customer. When you send the invoice, you increase the number of receivables you have. Your accounts receivable account increases. Since assets are increased by debits, debit the receivable under the assets in your books.

Remember, for every transaction you need to make two entries. When you make the sale, you give the customer a product. Your products are part of your inventory, which is an asset.

Your inventory decreases when you provide the product. Since assets are decreased by credits, credit the sale of inventory in your books.

Recap: When you make a sale and invoice a customer, debit the receivable and credit the sale in your books.

Accounts receivable turnover ratio

The accounts receivable turnover ratio measures how efficiently you collect receivables. The higher the ratio, the more efficiently your business collects receivables. The lower the ratio, the less efficiently your business is with accounts receivable collections.

To find the accounts receivable turnover ratio, divide the net credit sales by the average account receivables:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivables

Net credit sales include revenue generated by extending credit. It does not include sales paid immediately with cash, checks, or credit and debit cards. To find the net credit sales, calculate your total credit sales minus returns, allowances, and discounts.

The average accounts receivable is the total of the beginning and ending accounts receivable divided by two.

For example, last year, a company had $800,000 in net credit sales. At the beginning of the year, its accounts receivable was $40,000. At the end of the year, its accounts receivable was $50,000.

- Average Accounts Receivable = ($40,000 + $50,000) / 2 = $45,000

- Accounts Receivable Turnover Rate = $80,000 / $45,000 = 1.78

The accounts receivable turnover ratio is simply a number. For the ratio to be useful, you need to compare it to your industry’s average. You can also gauge your ratio over time to see if your accounts receivable process improves.

How to collect receivables faster

You might realize you need to improve your process for collecting invoices. Review your collection process to see if you can simplify how customers pay you. The easier it is for customers to make payments, the faster you collect receivables.

Set clear invoice payment terms. Invoices should answer the following questions:

- Where do I send the payment?

- Who do I address the payment to?

- How should I pay (i.e., check or cash)?

- When should I pay?

- Do I receive perks if I pay early?

- Am I penalized if I pay late?

- How can I reach the business?

If a customer does not pay by the due date, you might need to send a collections letter or charge a late payment fee.

If it is an ongoing problem and a customer owes you a lot of money, you might want to hire a collection agency. Usually, the agency charges you a fee or percentage of the amount collected.

If you cannot collect a receivable, it is called bad debt. You can subtract bad debt from your gross income on your tax return. You must have reported the debt as income on the previous tax return to claim the bad debt.

Why accounts receivable is important

Many times, it’s easier to make a sale on credit rather than having the customer pay up front. A customer might not have the cash on hand needed to pay the total amount due.

For example, if you build an addition to someone’s house, you probably wouldn’t expect them to pay you the total cost up front. Instead, you invoice them so they can pay you in several installments.

Offering credit to customers is a great way to offer convenience and widen your customer reach. But, you need to track where you extend credit carefully. Accounts receivable shows you how much money your customers owe your business.

The time it takes customers to pay invoices affects your small business cash flow. Cash flow is the inflow and outflow of cash in your business. Accounts receivable shows you money you expect to receive and how quickly to expect it. This information helps you with budgeting and planning.

Do you need a simple way to track your business’s incoming money? Patriot’s online accounting software makes it easy to manage your books. We offer free, USA-based support. Try it for free today.

This article has been updated from its original publication date of August 23, 2012.

This is not intended as legal advice; for more information, please click here.