You’ve heard about debits and credits. You know they increase and decrease certain accounts. But, how much do you know about the accounts they affect? There are five types of accounts in accounting.

If you don’t know what they are, your crash course has arrived.

Read on to learn about the different types of accounts with examples, dive into sub-accounts, and more.

Types of accounts in accounting

When you buy or sell goods and services, you must update your business accounting books by recording the transaction in the proper account. This shows you all the money coming into and going out of your business. And, you can see how much money you have in each account. Sort and track transactions using accounts to create financial statements and make business decisions.

Generally, businesses list their accounts by creating a chart of accounts (COA). A chart of accounts lets you organize your account types, number each account, and easily locate transaction information.

So, what are the accounts you need to keep track of? There are five main types of ledger accounts…

5 Types of accounts

Although businesses have many accounts in their books, every account falls under one of the following five categories:

- Assets

- Expenses

- Liabilities

- Equity

- Revenue (or income)

Familiarize yourself with and learn how debits and credits affect these accounts. Then, you can accurately categorize all the sub-accounts that fall under them.

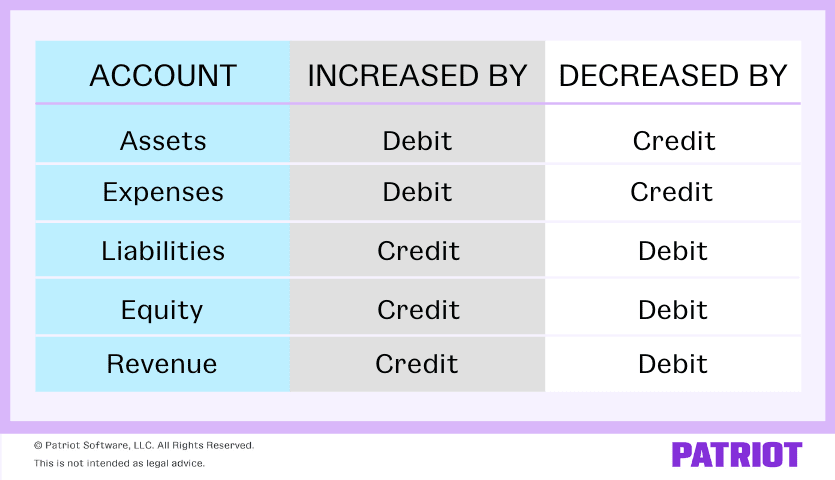

So, how do debits and credits affect asset, expense, liability, equity, and revenue accounts? Do debits decrease or increase these accounts in your books? How about credits?

Assets and expenses increase when you debit the accounts and decrease when you credit them. Liabilities, equity, and revenue increase when you credit the accounts and decrease when you debit them.

Here’s a quick-reference chart you can use to get started:

A detailed look at the types of accounts—and their sub-accounts

By this point, you might be wondering about all the other accounts you’ve seen and heard of. Where’s the Checking account? The Petty Cash account? The Accounts Payable account? These are all examples of accounts you may have in your five main accounts. But, you can break things down even more.

Rather than listing each transaction under the above five accounts, businesses can break accounts down even further using sub-accounts.

Sub-accounts show you exactly where funds are coming in and out of. And, you can better track how much money you have in each individual account.

Let’s say you make utility payments. Rather than listing out each type of utility expense in your Expense category, you can use utility sub-accounts to group them under Utilities. This shows you exactly how much money you’re spending in utilities.

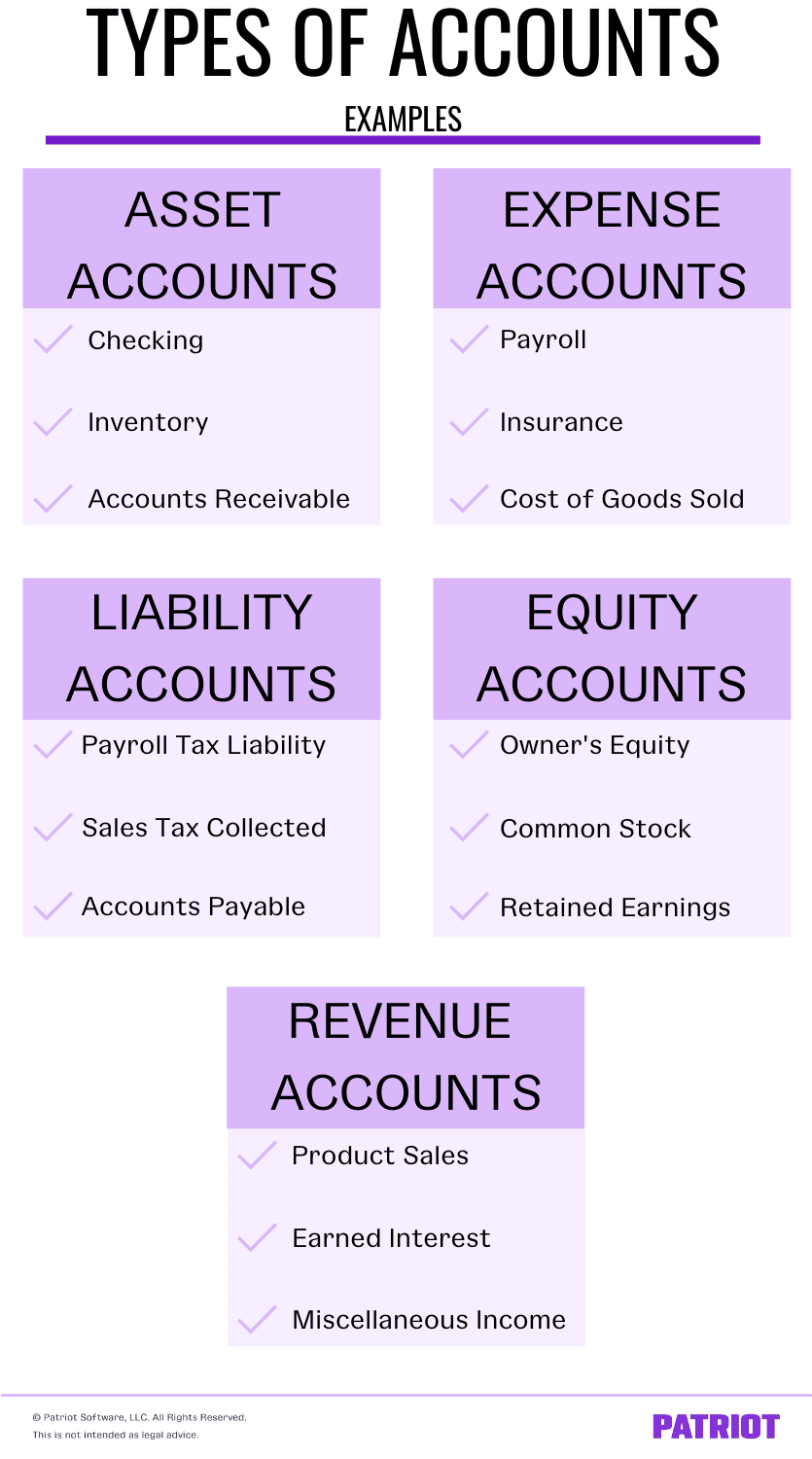

Here are some accounts and sub-accounts you can use within asset, expense, liability, equity, and income accounts.

Asset accounts

Assets are the physical or non-physical types of property that add value to your business. For example, your computer, business car, and trademarks are considered assets.

Some examples of asset accounts include:

- Checking

- Petty Cash

- Inventory

- Accounts Receivable

Although your Accounts Receivable account is money you don’t physically have, it is considered an asset account because it is money owed to you.

Again, debits increase assets and credits decrease them. Debit the corresponding sub-asset account when you add money to it. And, credit a sub-asset account when you remove money from it.

Example

Let’s look at an example. You sell some inventory and receive $500. You put the $500 in your Checking account. Increase (debit) your Checking account and decrease (credit) your Inventory account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Checking | 500 | |

| Inventory | 500 |

Expense accounts

Expenses are costs your business incurs during operations. For example, office supplies are considered expenses.

Examples of accounts that fall under the expense account category include:

- Payroll

- Insurance

- Rent

- Equipment

- Cost of Goods Sold (COGS)

Remember that debits increase your expenses, and credits decrease expense accounts. When you spend money, you increase your expense accounts.

You can set up sub-accounts for insurance (e.g., general liability insurance, errors and omissions insurance, etc.) to further break things down.

Example

Let’s say you spend $1,000 on rent. You pay for the expense with your Checking account. Increase your Rent Expense account with a debit and credit your Checking account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Rent Expense | 1,000 | |

| Checking | 1,000 |

Liability accounts

Liabilities represent what your business owes. These are expenses you have incurred but have not yet paid.

Types of business accounts that fall under the liability branch include:

- Payroll Tax Liabilities

- Sales Tax Collected

- Credit Memo Liability

- Accounts Payable

Accounts payable (AP) are considered liabilities and not expenses. Why? Because accounts payables are expenses you have incurred but not yet paid for. As a result, you add a liability, or debt.

Credit liability accounts to increase them. Decrease liability accounts by debiting them.

Example

You buy $500 of inventory on credit. This increases your Accounts Payable account (credit). And, it increases the amount of inventory you have (debit). Your journal entry might look something like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Inventory | 500 | |

| Accounts Payable | 500 |

Equity accounts

Equity is the difference between your assets and liabilities. It shows you how much your business is worth.

Here are a few examples of equity accounts:

- Owner’s Equity

- Common Stock

- Retained Earnings

Again, equity accounts increase through credits and decrease through debits. When your assets increase, your equity increases. When your liabilities increase, your equity decreases.

Example

You invested in stocks and received a dividend of $500. To reflect this transaction, credit your Investment account and debit your Cash account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | 500 | |

| Investment | 500 |

Revenue accounts

Last but not least, we’ve arrived at the revenue accounts. Revenue, or income, is money your business earns. Your income accounts track incoming money, both from operations and non-operations.

Examples of income accounts include:

- Product Sales

- Earned Interest

- Miscellaneous Income

To increase revenue accounts, credit the corresponding sub-account. Decrease revenue accounts with a debit.

Example

Say you make a $200 sale to a customer who pays with credit. Through the sale, you increase your Revenue account through a credit. And, increase your Accounts Receivable account through a debit.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Accounts Receivable | 200 | |

| Revenue | 200 |

Quick-reference list of accounts in accounting

Keeping track of your different types of accounts in accounting can be a challenge. Remember, you can create a chart of accounts to stay organized.

Use the list below to help you determine which types of accounts you need in business.

Does your accounting method influence your accounts?

Will you use all of the above types of accounts in accounting?

The types of accounts you use depend on the accounting method you select for your business. You can choose between cash-basis, modified cash-basis, and accrual accounting.

If you use cash-basis accounting, do not use liability accounts like accounts payable and long-term liabilities.

Modified cash-basis and accrual accounting use the same accounts, which are advanced accounts such as AP and long-term liabilities.

This article has been updated from its original publication date of June 25, 2019.

This is not intended as legal advice; for more information, please click here.