As a business owner, you do it all. But when it comes to your finances, it may be a good idea to consult an accounting expert for help—especially if you’re just starting your venture. An accountant can assist with tracking and analyzing your finances and keeping your records up-to-date and accurate. But, it all starts with you knowing what kind of questions to ask an accountant.

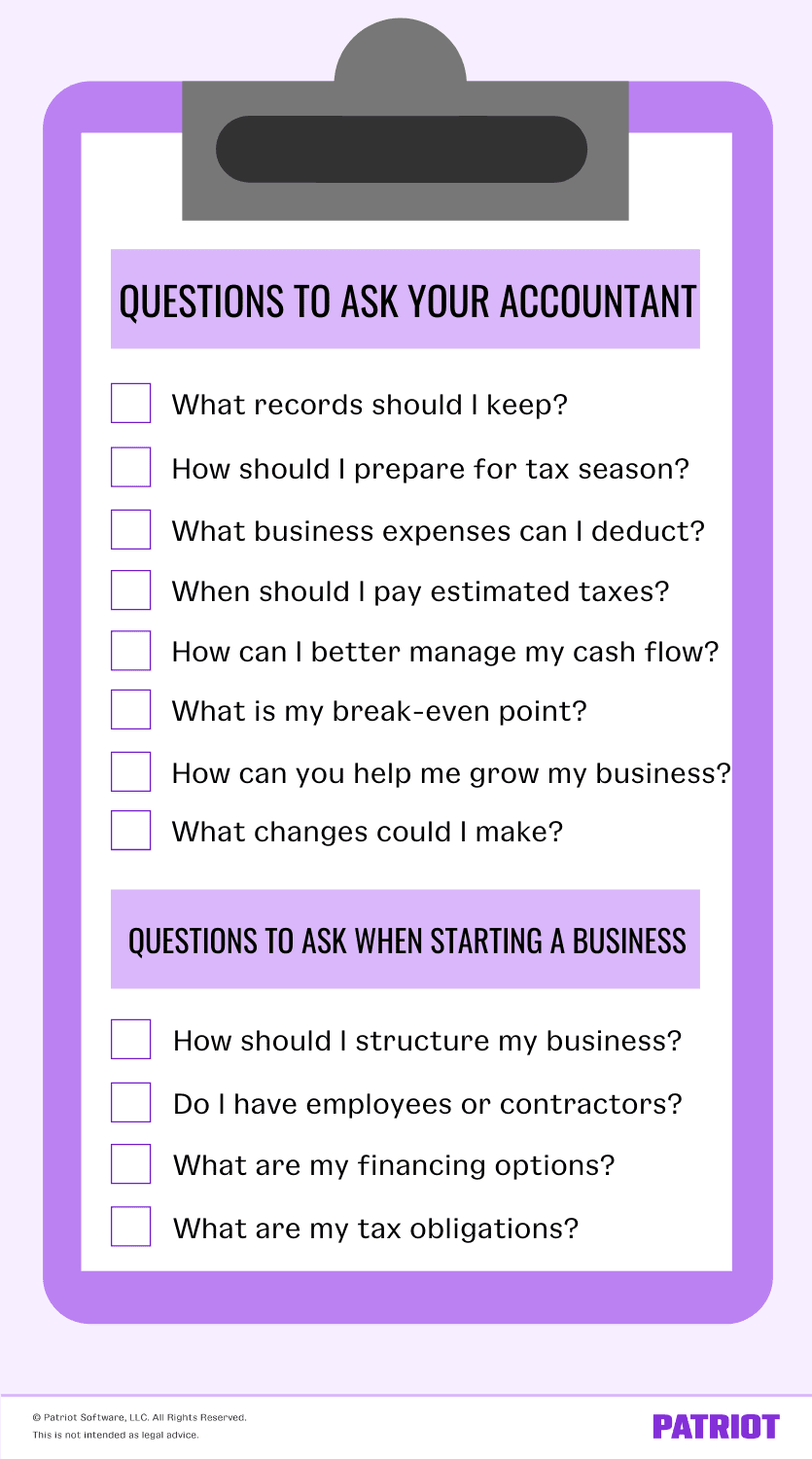

Questions to ask an accountant

When choosing an accountant to work with, find someone who specializes in small business. And, you should find an accountant that’s familiar with your industry. Caron Beesley, a contributor for the Small Business Administration, said:

“Small businesses have dynamic and sometimes complex accounting needs and few resources to manage them. An accountant who understands these dynamics and has a solid small business client base will likely serve your needs better in the long run.”

Whether you’ve worked with a professional for years or it’s your first meeting, make sure you know what questions to ask your accountant.

1. What records should I keep?

You need to keep track of business records to file taxes, measure profitability, and secure funds. Not to mention, you should always keep records handy in case of an audit. An accountant can tell you which records your business needs.

Ask your accountant which records you need to file away for safekeeping. Some typically include:

- Business tax returns

- Financial statements

- Income statements

- Balance sheets

- Cash flow statements

- Statement of retained earnings

- General ledger

- Bank statements

- Credit card statements

- Check registers

- Receipts

- Contracts

- Business agreements (e.g., operating agreement)

- Business licenses and permits

- Insurance documents

- Payroll records (e.g., payroll tax forms, pay stubs, etc.)

To simplify the recordkeeping process, you may want to have both paper and digital copies. And, store them in a secure place (e.g., locked filing cabinet).

Keep in mind that you need to keep each type of record for a certain period of time. The IRS has a time frame for certain records while the Fair Labor Standards Act (FLSA) sets the duration for other records. Check with your accountant to find out how long you need to keep each type of record for.

2. How should I prepare for tax season?

An accountant can file and remit your business taxes on your behalf. This includes filing all of those pesky accounting forms and remitting your tax liabilities to the proper agencies.

To make tax season a breeze for both you and your accountant, ask your accountant what information you need to gather for them ahead of time. And, ask them how you can better organize your records to make tax filing easier (e.g., using accounting software). The more organized your records are, the less time it will take your accountant to prepare the tax forms.

3. What business expenses can I deduct?

Depending on your business and expenses, you may be able to deduct certain business expenses on your tax return. Here are a few business tax deductions you may be eligible for:

- Home office

- Business use of car

- Business travel

- Employee expenses

- Charitable contributions

When claiming small business tax deductions, you need to be careful. Each type of deduction has a specific set of rules you must follow.

Ask your accountant which business tax deductions you’re eligible for. Your accountant can help you iron out which ones to take advantage of and how to claim them.

4. When should I pay estimated taxes?

As a business owner, you may be responsible for paying estimated taxes. Estimated tax is a method that individuals use to pay tax on income that is not subject to withholding taxes. Basically, you may need to pay estimated taxes if taxes are not withheld from your income.

You might need to pay estimated taxes if you receive income that isn’t subject to withholding, such as:

- Dividends

- Gains from sales of stock

- Self-employment income

- Interest income

Talk to your accountant about estimated taxes and whether or not you need to pay them each quarter. Your accountant can file and remit estimated taxes for you.

5. How can I better manage my cash flow?

As a business owner, one of your main goals is to maintain a healthy (and positive) cash flow. To ensure your cash flow doesn’t head into negative territory, ask your accountant how you can better manage yours.

Your accountant can help you understand your cash flow, pinpoint and analyze problems, and establish a plan to improve it. Plus, your accountant can help you come up with a cash flow projection to plan and manage for the future.

6. What is my break-even point?

Your break-even point occurs when your total sales equal your total expenses. When you break-even, you’re finally making enough to cover your operating costs.

Your break-even point is essential for pricing your products and/or services. It can help you set a budget, control costs, and decide on a pricing strategy.

Your accountant can use your financial records to calculate what your business’s break-even point is. By knowing your point, you can determine if your company is making a profit, losing money, or just breaking even.

7. How can you help me grow my business?

Every business’s goal is to grow in some shape or form. Maybe you want to eventually open a second location. Or, maybe you want to expand your offerings. When talking to your accountant, ask them how they can help your business grow.

Accountants are financial and tax experts. Therefore, they know which opportunities best promote growth and what you need to steer clear from. Your accountant can track your financial progress and see what’s holding your business back (e.g., overspending on XYZ). And, they can help you project your cash flow so you can better plan for future expenses and opportunities.

8. What changes could I make that would help my business?

Your accountant is an expert in all things taxes and finances. And after you get to know each other, your accountant will be an expert in your business. That’s why you need to ask your accountant the question, What changes could I make that would help my business?

Sure, your accountant isn’t going to have all of the answers when it comes to your small business. But, they can help steer you in the right direction and give you some good advice.

Have your accountant analyze your business regularly. That way, they can see where you can make improvements and what changes you can make to help your business.

Just starting a business? Ask these 4 questions

Thinking about starting a business? Just recently started one? To start your company off on the right foot, consult an accountant and ask these four questions.

9. How should I structure my business?

Choosing a business structure is one of the first steps you take when you start your business. And, there are pros and cons to each type of business structure. Luckily, an accountant can point you in the right direction.

Here are the different types of business structures:

- Sole proprietorship: Owned and operated by one person

- Partnership: Two or more individuals own and operate together

- Corporation or C Corp: Separate legal entity from its owners

- S corporation or S Corp: Type of corporation where profits and losses are passed directly to the owner’s personal income without being subject to corporate tax rates

- Limited liability company (LLC): Combines aspects of a corporation and partnership

Each structure has its own set of rules when it comes to taxes and legal liability. An accountant can discuss the legal structures in depth to help you determine which one is best for your business. Your accountant can also assist you with filling out the correct documents for the legal structure you select.

10. Are the people who work for me employees or independent contractors?

A huge responsibility of becoming an employer is classifying your employees. Is your new worker an employee or an independent contractor? Misclassifying your workers could lead to tax problems and penalties. Thankfully, asking your accountant for assistance can help you avoid worker misclassification issues.

There are major differences between W-2 employees and independent contractors. With an employee, you are responsible for withholding and remitting payroll taxes. But with an independent contractor, you don’t withhold or pay any payroll taxes for them.

Your accountant can help you sift through the gray areas of classifying employees and independent contractors to ensure you don’t make any mistakes.

11. What are my financing options?

Although this is a question you can bring up to your accountant at any time during your entrepreneurial journey, you should definitely ask it when you are first forming your business.

To grow your business, you may need additional funds to take on larger projects. Your accountant can help you sort out the best small business financing options.

Some funding options include:

- Loans

- Business credit cards

- Investors

- Crowdfunding

Your accountant can tell you the difference between all of your options, list off the pros and cons of each, and assist you in obtaining financing. And, your accountant may be able to refer you to certain lenders that they know.

12. What are my tax obligations?

Your first tax season as a business owner can be stressful. And as a new business owner, you may not know what your tax obligations exactly are. To make sure you understand your tax obligations, ask your accountant what they are.

Depending on your business, you may need to file and remit:

- Corporate income taxes

- Personal income taxes

- Payroll taxes

- Employment taxes

- Sales taxes

- Excise taxes

- Self-employment taxes

- Estimated taxes

Talk with your accountant to figure out which taxes apply to you and your business. And, discuss the process of filing and remitting your taxes (e.g., when they are due, what forms to use, etc.).

Revisit this question from time to time to ensure your business is staying up-to-date with new tax laws and regulations.

Need an easy way to track your business’s transactions and gather reports for your accountant? Patriot’s online accounting software is easy-to-use and affordable. Plus, we offer free, USA-based support. What are you waiting for? Try it for free today!

This article was updated from its original publication date of October 20, 2016.

This is not intended as legal advice; for more information, please click here.