Thanks to the COVID pandemic, 58% of employees sometimes or always work remotely now. Unfortunately for those employees, they can no longer claim the home office tax deduction (talk about an unlucky sequence of events). But lucky for you, you’re a business owner. And that means this tax deduction is still available.

The home office deduction isn’t for all business owners who work from home, though. Read on for answers to the following questions:

- What is the home office tax deduction?

- Who can claim the working from home tax credit?

- How much is home office deduction?

- What forms do you need to file?

- What are your recordkeeping requirements?

What is the home office tax deduction?

The home office deduction is a tax deduction qualifying small business owners can claim if they use part of their home for business. Small business owners include:

- Self-employed taxpayers

- Independent contractors

- Those working in the gig economy

Under the Tax Cuts and Jobs Act of 2017, employees cannot claim the tax deduction between 2018 – 2025. So, there are no remote worker tax deductions for the home office.

If you are an eligible small business owner, you can only claim the portion of your home that you use for business. The deduction helps you cover the costs associated with your home office, such as mortgage interest, rent, insurance, utilities, and maintenance.

Taking the home office expense deductions reduces your tax liability, which could save you a significant amount of money.

Who can claim working from home tax credit?

You might be wondering, Can I write off my home office? Again, only qualifying small business owners can claim the work-from-home tax deductions.

To qualify, you must follow these two rules:

- You use the space regularly and exclusively for business: You use a specific portion of your home only for business.

- The space is the principal place of your business: Your home office must be your primary place of business. However, you can conduct business in other locations (e.g., meeting a client for lunch).

The IRS lets you claim the tax deduction regardless of if you own or rent your home. The IRS defines the following as a home:

- House, apartment, condo, mobile home, boat, or similar property

- Free-standing buildings, such as unattached garages, studios, barns, and greenhouses

If you use a free-standing building, you must regularly and exclusively use the space for business, but it doesn’t have to be the principal place of business.

You may also qualify for the tax credit if you use your home:

- On a regular basis for storing inventory or samples for product sales (retail or wholesale)

- For rental use

- As a daycare facility

For more information, consult IRS Publication 587.

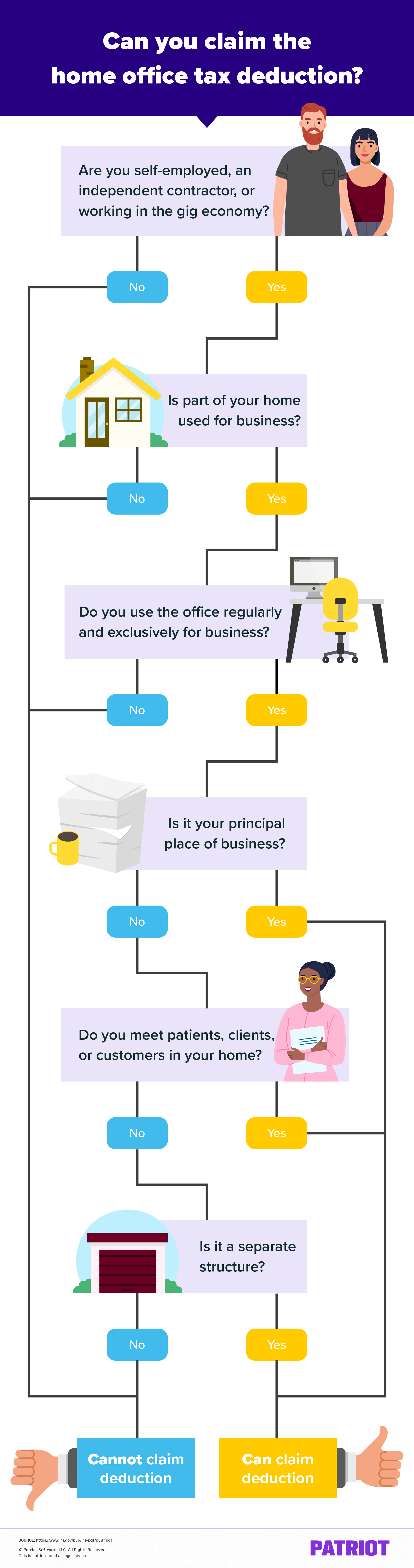

Can you claim the home office tax deduction? [Flowchart]

Determining whether you qualify for the deduction can be confusing. Take a look at our flowchart to decide if you can take the deduction:

How much is home office deduction?

The amount of your work-from-home tax deductions depends on whether you use the simplified method or the actual expense method.

Some business owners decide which method to use based on which gives a better deduction. Learn more about each method below.

Simplified method

The simplified method is easier than the actual expense method. To use this method, multiply the square feet of your home office space by the standard deduction rate of $5.

Keep in mind that you can only claim up to 300 square feet for your home office. Therefore, the maximum amount of your tax deduction is $1,500.

Your deduction must be less than the amount of your gross income (from business use of your home) minus business expenses. And, you cannot deduct depreciation on the portion of your home used for business if you use the simplified method.

Let’s say your home office is 250 square feet. Using the standard deduction rate of $5, you could claim a tax deduction of $1,250 (250 X $5).

Actual expense method

The actual expense, or regular, method lets you determine how much you actually spend on your home office.

To use this method, calculate the actual expenses of your home office, such as:

- Mortgage or rent

- Mortgage interest

- Real estate taxes

- Insurance

- Utilities

- Repairs

- Depreciation

Next, you need to calculate the percentage of your home that you use (regularly and exclusively) for business.

Now, multiply your total expenses by the percentage of your home you use for business.

Let’s say you have $10,000 in annual expenses for your home. Your home office takes up 15% of your house. Using the actual expense method, you could deduct $1,500 for your home office expenses ($10,000 X 0.15).

What forms do you need to file?

Use Schedule C (Form 1040) to report your expenses. Report your expenses on line 30.

If you use the simplified method, you can claim the deduction right on Schedule C.

If you claim the home office tax deduction using the actual expense method, you also need to attach Form 8829, Expenses for Business Use of Your Home.

What are your recordkeeping requirements?

To claim the home office tax deduction, you need accurate and organized records. Your records must show the part of your home you use for business. And, keep records showing that you followed the IRS’s home office tax deduction rules.

If you decide to use the actual expense method, stay extra organized. Store receipts to back up your expense claims. And, show depreciation.

Keep records for either three years after filing your return or two years after the tax was paid, whichever is later.