Your to-do list as a business owner seems to get longer every day. There’s one more item you’ll have to check off—and this one is part of federal law. You’re required to retain payroll records, sometimes for up to four years.

Don’t worry. This isn’t an impossible task. This article covers the agencies that require payroll records and how long to keep payroll records.

What are payroll records?

Payroll records is a broad term that covers all the documentation you use to track employee hours, salary, and any other information related to how they are paid.

Here are some (but not all) of the records you need to keep track of:

- Names, addresses, and Social Security numbers of all employees

- Workweek information (e.g., start and end dates)

- Hours worked each day/total hours worked each week

- How each employee is paid (e.g., hourly, salary)

- Pay rate

- Overtime earnings (if applicable)

- Additions to or deductions from wages

- Total wages paid each period

- Employee reported tips and allocated tips

- Payment dates and pay periods

- Forms W-2 and W-3

- Forms W-4 and W-5

- Form 941 or 944

- Records of benefits

- Copies of filed returns with confirmation numbers

There’s a chance that there are other payroll records you need to keep, like travel vouchers or receipts for employee reimbursements.

To be clear, payroll records can include records for employment taxes and records showing how you determined employee wages.

How long to keep payroll records

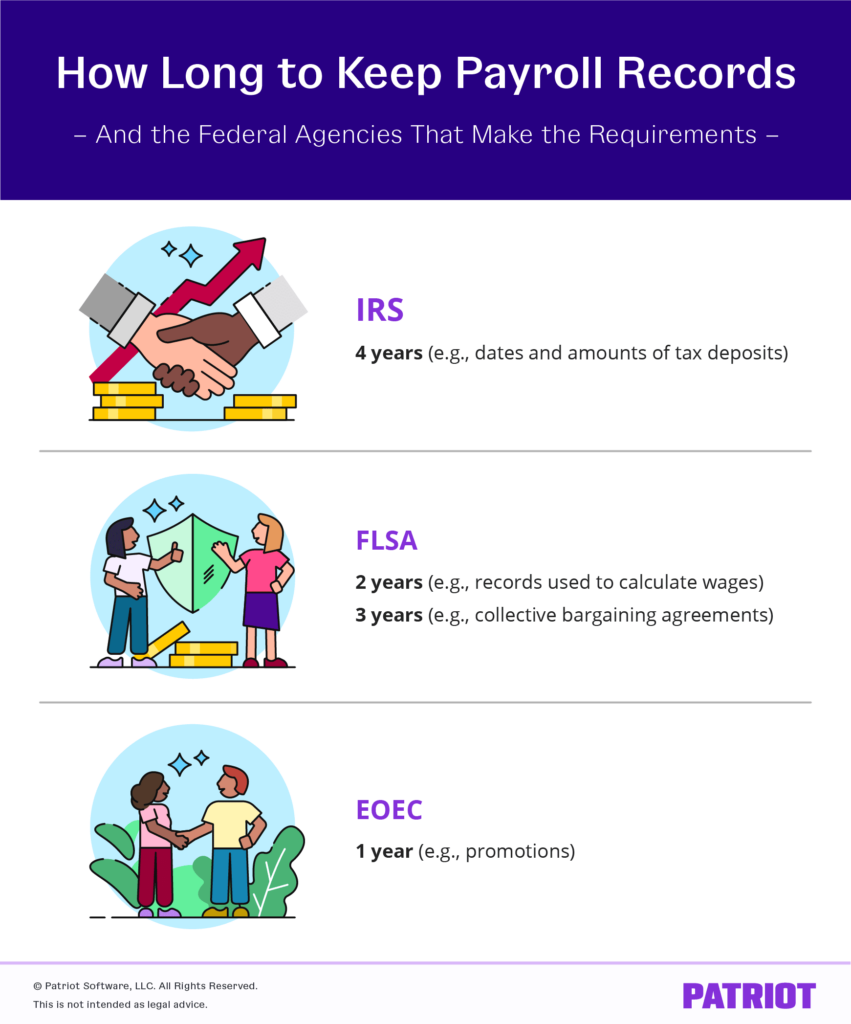

Three federal agencies require you to keep employment payroll records. There’s just one problem—different agencies have different records they want you to keep with different lengths of time for you to keep them.

Read on to see the breakdown.

IRS

The IRS requires that you keep payroll records such as amounts and dates of wages, dates of employment, and dates and amounts of tax deposits.

Keep these records for four years after filing the fourth quarter of the year.

Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) requires that you keep identifying information on each employee as well as information about their hours and pay rate (e.g., employee gender and occupation, total hours worked each workweek and regular hourly pay rates).

Keep records concerning payroll, collective bargaining agreements, as well as sales and purchase records for at least three years. Keep records used to calculate wages for two years.

Equal Employment Opportunity Commission

The Equal Employment Opportunity Commission (EEOC) requires that you keep detailed employment records (e.g., employee applications and any records dealing with promotions, demotions, or terminations). If needed, these records can prove or disprove an employee was discriminated against when they were fired.

Keep records concerning employment (hiring, promotion, demotion, or termination) for one year after the record was created. If someone files a charge of discrimination under Title VII, the ADA, or GINA, hold on to all records related to the charge until the final disposition of the charge.

State requirements

Some states may require that you hold on to payroll records a bit longer. For example, California and Arizona require four years, while Montana requires you to keep records for five.

To make things a bit more complicated, states might also have different requirements on what type of records you need to keep. Check with your state for specifics.

Storing payroll records

It’s up to you how you store your payroll records. You can use hard copies in locked filing cabinets if you’d like. But, storing payroll records online can help protect them from getting lost or damaged.

Interested in a better way to handle payroll and HR tasks? Sign up for Patriot Software to get a free trial of our payroll software and HR software add-on today.

This article has been updated from its original publication date of June 1, 2011.

This is not intended as legal advice; for more information, please click here.