Does your business hire independent contractors, gig workers, or freelancers? If so, congratulations—you get to learn the ins and outs of IRS Form W-9! So, what’s the scoop with the IRS W-9 form? What exactly is it used for? Who needs to fill one out? We have the answers to all of your burning questions (and more!) below.

What is a W-9 form?

First things first, what is a W-9 tax form? Form W-9, Request for Taxpayer Identification Number and Certification, is a form that businesses must obtain from independent contractors for tax purposes. In turn, businesses use the form to accurately prepare a 1099 form for independent contractors at year-end. Contractors use the form to report their taxpayer identification number (TIN) to a business they perform work for.

IRS Form W-9 terminology to know

If you have to deal with W-9 forms, there are a few terms you need to know like the back of your hand. These include:

- Taxpayer identification number

- Backup withholding

- Form 945

Taxpayer identification number

A taxpayer identification number is a specific number assigned to individuals and businesses by the IRS or Social Security Administration (SSA). When it comes to Form W-9, individuals can either provide their Social Security number or Employer Identification Number (EIN) for their TIN.

Backup withholding

Typically, individuals who receive a W-9 form do not need anything withheld from their payments. However, In some cases, backup withholding comes into play.

So, what is backup withholding? Backup withholding requires you to withhold a 24% tax from the wages of a contractor, freelancer, etc. and pay it to the IRS. You may need to withhold and remit backup withholding if the:

- Individual did not provide a correct TIN on their W-9 form

- Contractor did not certify their TIN

- IRS tells you the TIN is incorrect

- IRS tells the contractor their payments are subject to backup withholding because they didn’t report interest and dividends on their tax return

Check out the IRS’s payments subject to backup withholding for more information.

Form 945

Form 945, Annual Return of Withheld Federal Income Tax, goes hand in hand with backup withholding. If a contractor’s payments are subject to backup withholding, use Form 945 to report the amount you collect from the independent contractor for the withholding.

Form W-9 vs. Form W-4

In many cases, business owners gather Form W-9 from contractors so they can provide Form 1099-NEC, Nonemployee Compensation, come tax time. Think of Form W-9 as a Form W-4 for contractors. When you hire a contractor to do work for your company, have them fill out Form W-9 just like you would have an employee fill out a W-4 when you hire them.

While Form W-9 is for vendors, contractors, etc. who receive nonemployee compensation and is solely for informational purposes. On the other hand, employers must use Form W-4 to determine how much to withhold in federal income taxes from an employee’s paychecks.

What is a W-9 form used for?

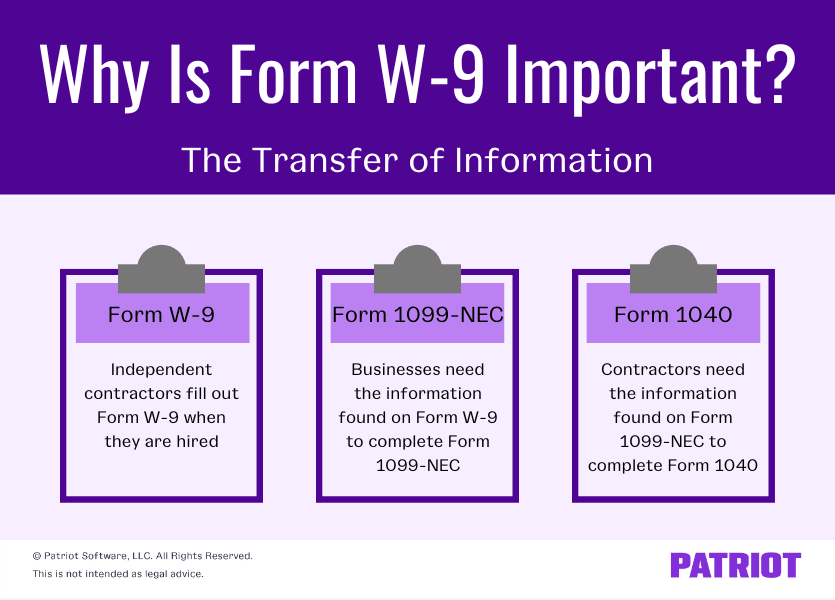

Form W-9 tells you an independent contractor’s information so you can correctly fill out Form 1099-NEC.

You are required to report nonemployee compensation on Form 1099-NEC. You must send a copy of 1099-NEC to the:

- Independent contractor

- IRS

- State tax department (if applicable)

You must also keep a copy of Form 1099-NEC in your records along with Form W-9.

Independent contractors use Form 1099-NEC to fill out their individual income tax return, Form 1040.

What is on the form?

Gather Form W-9 from all applicable individuals. The person who fills out the form must provide the following information:

- Name

- Business or entity name, if applicable

- Tax classification (e.g., LLC)

- Exemptions

- Address

- TIN

- Signature

Be sure to have Form W-9 on file for each independent contractor you hire and pay $600 or more in nonemployee compensation during the tax year.

Who needs to fill out a W-9?

Contractors aren’t the only ones who have to fill out Form W-9. You may also need to use Form W-9 to report other types of income, including:

- Real estate transactions

- Mortgage interest

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions made to an IRA

If you’re unsure about if you need to complete or fill out Form W-9, check out the IRS’s Form W-9 Instructions. Or, contact the IRS directly.

Where do you send Form W-9?

Do not send Form W-9 to the IRS. Instead, keep a copy of it in your records. You can keep a paper copy, or you can store a digital copy on your devices (e.g., computer) for safekeeping.

How do I get a W-9?

As the business owner, you are required to get Forms W-9 for your independent contractors. You can download a printable W-9 form straight from the IRS’s website.

This article has been updated from its original publication date of August 29, 2017.

This is not intended as legal advice; for more information, please click here.