The Department of Labor recovered over $274 million in back wages and damages in 2023 due to wage violations. Employers who use illegal payroll practices owe back the money they “steal” from employees and are subject to hefty penalties. Plus, these businesses lose the trust of their workers and harm their employer brand.

In short, you do not want to deal with wage issues. And if you do make a mistake, you must admit it and quickly fix it.

Read on to understand wage violations and what you can do to prevent them.

11 Wage violations you don’t want to make

Mistakes can happen to anybody, especially to a small business owner who’s wearing a million and one different hats.

However, you don’t want to accidentally violate wage laws or purposely skimp out on paying employees to save money.

Labor laws, like the Fair Labor Standards Act (FLSA), are in place for a reason—to protect workers. These laws and regulations help prevent wage issues and provide a safeguard for employees who are victims of wage violations.

As an employer, you need to know about illegal payroll practices so you can save yourself the headache, lost reputation, and money by avoiding them.

Here are 11 wage violations you don’t want to make.

1. Purposely misclassifying workers as independent contractors

Worker classification is huge. Knowing the difference between independent contractor vs. employee is critical for correct classification.

Purposely misclassifying workers as independent contractors can quickly become a chain reaction that sets off other wage violations. The worker misses out on things like FLSA protection, unemployment insurance, employer-sponsored benefits, and correct taxation.

With the landmark California AB 5, you also need to know your state’s worker classification laws. For example, penalties of California’s law can be upwards of $25,000 per violation.

How to avoid: Pay attention to federal and state worker classification guidelines. If you’re still confused, file Form SS-8 with the IRS to help you determine a worker’s status.

2. Purposely misclassifying employees as exempt

When hiring employees, one of your key responsibilities is determining whether they are exempt vs. nonexempt.

What’s the difference? Why does it matter? Exempt employees are not protected by the FLSA’s minimum wage and overtime laws. Because of that, employers don’t have to give exempt employees overtime pay.

Some employers purposely misclassify employees as exempt so they don’t have to pay them overtime wages.

How to avoid: Understand the difference between exempt and nonexempt employees. Exempt employees must earn above the established salary threshold, be paid on a salary basis, and have job duties that are considered exempt.

3. Paying the wrong minimum wage

Minimum wage issues come up when employers fail to pay employees the right minimum wage.

Sure, you may know that the federal minimum wage is $7.25 per hour. But is that the minimum wage law you need to follow?

About half of the states set their own minimum wage, which is higher than the federal rate. And, a number of localities set an even higher minimum wage than the state one.

So, which do you follow? You must pay employees the highest minimum wage that applies to your business.

How to avoid: Knowing the federal minimum wage is a start, but you also need to know your state and local minimum wage laws to ensure you’re compliant. Once you know which minimum wage law to follow, pay employees at least that amount.

4. Skipping overtime

If your employees are nonexempt, you can’t forget to pay them the overtime rate. Overtime is one and one-half times an employee’s regular wages per hour worked above 40 in a workweek.

Some employers who violate overtime laws don’t pay employees at all when they work overtime. Others pay employees for overtime hours at the regular rate instead of the overtime rate.

Overtime calculations are a little different if an employee has multiple pay rates. Employers who don’t follow the FLSA’s weighted overtime rules may also be penalized.

How to avoid: Don’t forget to pay employees the overtime rate for each hour of overtime they work. Consider using payroll software to simplify recording and calculating overtime. Calculate weighted overtime if your employee has multiple pay rates. And if you don’t want employees to work overtime, make sure to let them know ahead of time.

5. Rounding errors

Math might not have been your favorite subject, but rounding is important when it comes to paying hourly employees.

What do you do if an employee comes in or leaves a few minutes early or late? The FLSA may require you to round employee time to a quarter hour of work.

Sometimes, you’re allowed to round down. But not all the time. Employers who constantly round down an employee’s time might be violating wage laws. You may need to round up, depending on the number of minutes.

How to avoid: Know the FLSA’s rounding rules and if they apply to you. If an employee is 1 – 7 minutes early or late, you can round down. If an employee is 8 – 14 minutes late or early, you must round up and count it as a quarter-hour of work. That means you must pay them for the quarter hour of work.

6. Not counting hours worked

The Fair Labor Standards Act requires employers to pay employees for time that counts as hours worked. This time is non-regular hours that still requires compensation.

Employers make wage violations when they refuse to pay nonexempt employees for hours worked. And sometimes, it can be difficult to determine if an employee is working when they aren’t engaged in their regular activities.

If your employees meet the requirements for hours worked, you can’t neglect to pay them for:

- Waiting time

- On-call time

- Rest and meal breaks

- Sleeping time

- Lectures, meetings, and training programs

- Travel time

How to avoid: Read up on FLSA hours worked rules if you have nonexempt employees. Pay employees if their time counts as hours worked.

7. Handling tips illegally

Do your employees earn tips? If they do, you could be violating wage laws if you attempt to keep some of their earnings. You could also have wage problems if you fail to give them at least the tipped minimum wage.

Let’s start with the tips themselves. Unless you have a tip pooling agreement, you cannot take an employee’s tips and distribute them to other workers. You cannot short your employees on their earned tips—this is especially easy for employers to do if a customer pays for a tip with a credit card. Keep in mind that you must still withhold and report taxes on tips.

Now, let’s get into the next tip-related wage issue: not paying employees at least the tipped minimum wage. Tips are supplemental income, meaning they are wages an employee earns in addition to their hourly rate. Employers must also pay employees the tipped minimum wage rate, which—like regular minimum wage—varies by state and city.

How to avoid: Give employees their full tip earnings after withholding taxes unless you have a tip pooling agreement. Keep records to back you up. And, know your tipped minimum wage rate and pay employees at least this amount per hour.

8. Failing to recognize paid time off laws

There are two ways you could be breaking paid time off laws and thus shortchanging your employees’ wages:

- Failing to provide paid sick leave if your state requires it

- Failing to provide PTO payout if your state requires it

Paid sick leave laws by state require employers to provide their workers with a specified number of sick days with pay. If your business is in one of the states (or D.C.) with paid sick leave laws and you do not pay employees for sick time, you are committing a wage violation.

Another paid time off-related law is for employers who decide to give employees paid vacation time. Some states ban use-it-or-lose-it policies, meaning employers must either roll over or pay out their employees’ unused time. And, some states require that employers pay out unused PTO at the time of termination.

How to avoid: Read up on your state’s laws regarding paid time off. Understand if you are required to give employees paid sick leave. And, familiarize yourself with PTO payout laws by state.

9. Disregarding final paycheck laws

Another illegal payroll practice is dragging your feet on an employee’s final paycheck. There are final paycheck laws by state that tell you when you must give employees their final paychecks.

If you don’t give employees their final paychecks within the state’s specified time frame, you could be in danger of a wage violation.

How to avoid: Know your state’s final paycheck laws. Unless your state requires you to provide it sooner, a good rule of thumb is to distribute the employee’s final wages no later than the next payday.

10. Not providing equal pay

Failing to provide your employees with similar roles, skill sets, experience, and education pay is another unlawful work practice.

The Equal Employment Opportunity Commission (EEOC) prevents employers from discriminating against employees due to their race, color, religion, sex, age, national origin, disability, or genetic information.

Employers cannot pay an employee less than another employee due to discrimination.

How to avoid: Conduct a pay audit to find out if you’re paying your employees fairly. If you learn that you are not providing equal pay to an employee, take action by adjusting your employee’s wages.

11. Withholding too much from payroll

As an employer, you’re responsible for withholding taxes and other deductions (e.g., health insurance premiums and wage garnishments) from your employees’ gross wages.

Employers must withhold income taxes and the employee portion of Social Security and Medicare taxes from an employee’s wages.

You cannot withhold extra money from an employee’s paycheck because you want to. And, do not withhold money to cover your employer portion of Social Security and Medicare taxes. You also cannot require employees to pay for employer taxes, like federal unemployment tax.

How to avoid: Be careful when calculating an employee’s tax liability. Do not withhold more than their liability for taxes. And, do not withhold the employer portion of employment taxes.

What to do if you make a mistake

If you make a wage-related mistake, don’t panic. Provide the employee with retro pay as quickly as possible.

Retro pay is money you owe an employee for work performed during a previous pay period. You must provide retro pay if you miscalculate regular or overtime wages or forget to apply a different pay rate to the employee’s wage calculations.

When you provide an employee with retro pay, don’t forget to withhold taxes. And, be sure to record the retro payment.

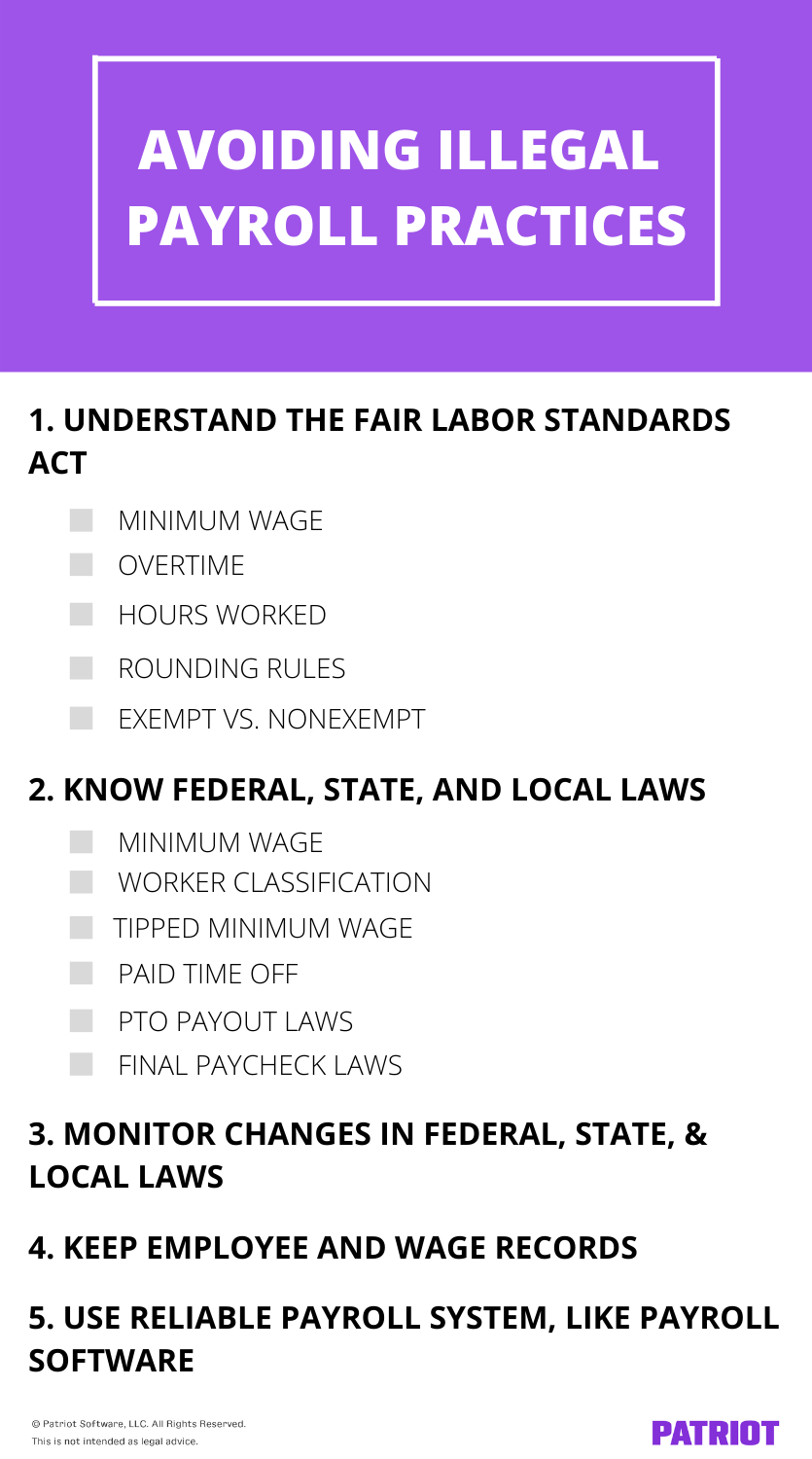

Avoiding illegal payroll practices: Checklist

Use our checklist to help you avoid unlawful practices in the workplace.

Handling payroll manually can leave room for wage violations. With Patriot’s online payroll, you don’t have to worry about calculating payroll. Plus, our software updates automatically to reflect new tax rates and wage bases. Start your free trial now!

This article has been updated from its original publication date of December 20, 2022.

This is not intended as legal advice; for more information, please click here.