Understanding the needs of your customers is essential for business success. Anyone can catch a customer’s eye with flashy marketing, but it takes dedication and quality of service to keep people coming back.

Read More How to Identify and Handle Customer Pain PointsSmall Business Blog

Small Business Tips and Training

Most popular blog categories

Small Business Digital Transformation: Definition and Examples

As a small business owner, you have to do more with less. You likely have fewer resources, fewer employees, and a lower budget than large corporations or the unicorns in Silicon Valley. Doing more with less is tricky (29% of business owners say it’s their #1 challenge), but it’s getting easier—thanks to small business digital […]

Read More Small Business Digital Transformation: Definition and Examples

How to Build an Engaging HR Communication Strategy for Small Business Employee Retention

HR communications are often overlooked when compared to marketing messages and ad campaigns. Misdirected marketing loses your customers. Poor internal communications lead to disengaged employees and higher turnover.

Read More How to Build an Engaging HR Communication Strategy for Small Business Employee Retention

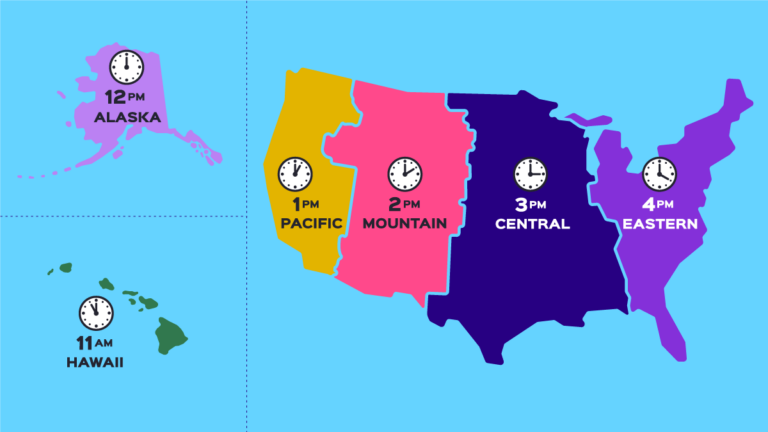

What Are the Different Time Zones in the USA, and Why Do Businesses Care?

Scoot over, Zoom fatigue. There’s a new sheriff in town: time zone fatigue. If you have one employee working in California, another in Wisconsin, and another in Maine, you’re probably already familiar with the condition. To get through the confusion, you need a cheat sheet to understand the different time zones in the USA. And, […]

Read More What Are the Different Time Zones in the USA, and Why Do Businesses Care?

What HR Professionals Need to Know About Benefits Administration

For HR professionals, benefits administration is becoming more and more important to consider.

Read More What HR Professionals Need to Know About Benefits Administration